Question: Question 2 The following data has been gathered for Carter Ltd. for the month ended April 30, 2019: There was an EFT deposit of $2,000

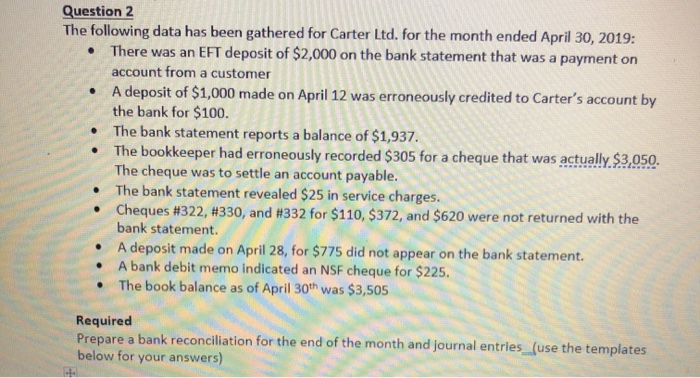

Question 2 The following data has been gathered for Carter Ltd. for the month ended April 30, 2019: There was an EFT deposit of $2,000 on the bank statement that was a payment on account from a customer A deposit of $1,000 made on April 12 was erroneously credited to Carter's account by the bank for $100. The bank statement reports a balance of $1,937. The bookkeeper had erroneously recorded $305 for a cheque that was actually $3,050. The cheque was to settle an account payable. The bank statement revealed $25 in service charges. Cheques #322, #330, and #332 for $110, $372, and $620 were not returned with the bank statement A deposit made on April 28, for $775 did not appear on the bank statement. A bank debit memo indicated an NSF cheque for $225. The book balance as of April 30th was $3,505 Required Prepare a bank reconciliation for the end of the month and journal entries_(use the templates below for your answers)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts