Question: Question 2 The following information are providing for three different client portfolion Delta Thema Gamma Fixpected return of client portfolio 202. 50% 90% Risk of

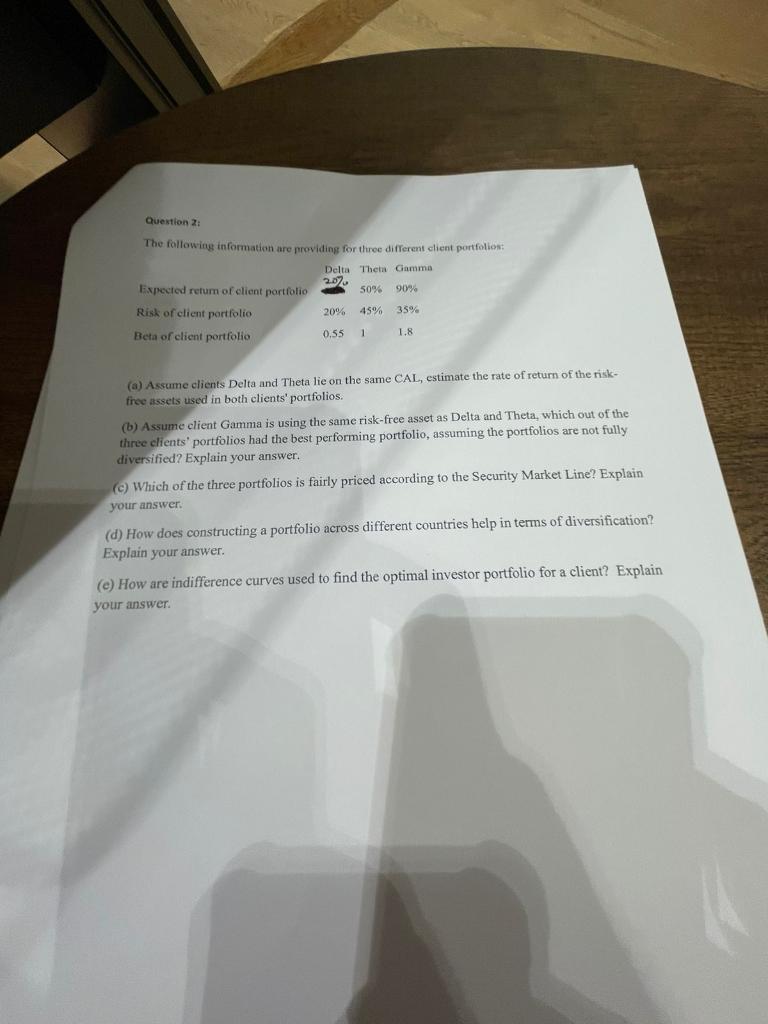

Question 2 The following information are providing for three different client portfolion Delta Thema Gamma Fixpected return of client portfolio 202. 50% 90% Risk of client portfolio 20% 459 35% Beta of client portfolio 0.55 1 1.8 (a) Assume clients Delta and Theta lie on the same CAL, estimate the rate of return of the risk- free assets used in both clients' portfolios. (b) Assume client Gamma is using the same risk-free asset as Delta and Theta, which out of the three clients' portfolios had the best performing portfolio, assuming the portfolios are not fully diversified? Explain your answer. (C) Which of the three portfolios is fairly priced according to the Security Market Line? Explain your answer. (d) How does constructing a portfolio across different countries help in terms of diversification? Explain your answer. (e) How are indifference curves used to find the optimal investor portfolio for a client? Explain your answer. Question 2 The following information are providing for three different client portfolion Delta Thema Gamma Fixpected return of client portfolio 202. 50% 90% Risk of client portfolio 20% 459 35% Beta of client portfolio 0.55 1 1.8 (a) Assume clients Delta and Theta lie on the same CAL, estimate the rate of return of the risk- free assets used in both clients' portfolios. (b) Assume client Gamma is using the same risk-free asset as Delta and Theta, which out of the three clients' portfolios had the best performing portfolio, assuming the portfolios are not fully diversified? Explain your answer. (C) Which of the three portfolios is fairly priced according to the Security Market Line? Explain your answer. (d) How does constructing a portfolio across different countries help in terms of diversification? Explain your answer. (e) How are indifference curves used to find the optimal investor portfolio for a client? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts