Question: Question 2 The following represents an extract from the Statement of Financial Position of the assets and liabilities of Pisform Limited for the years ending

Question 2

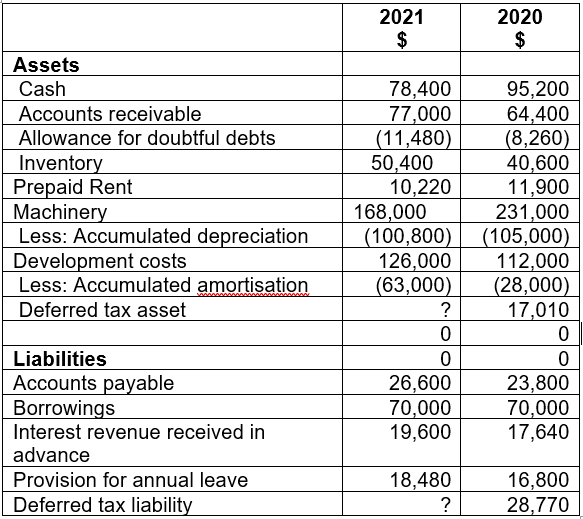

The following represents an extract from the Statement of Financial Position of the assets and liabilities of Pisform Limited for the years ending 30 June 2021 and 2020.

Additional Information:

a) Doubtful debts are deductible for tax purposes when the debt is written off.

b) Interest and rent is assessable when the cash is received and deductible when the cash is paid.

c) A tax deduction for development costs can be claimed when the costs are paid.

d) Pisform Ltd sold an item of machinery on 1 March 2021 for $36,400. For tax purposes, the carrying amount of equipment sold was $26,600. There were no other disposals or acquisitions of equipment during the year.

e) The tax deduction for depreciation for 2021 was $25,200 and the accumulated depreciation at 30 June 2020 for taxation purposes was $91,000.

f) Annual leave is deductible when the payment is made.

g) The current tax rate is 30%

Required:

Prepare the deferred tax worksheet for Pisform Limited for the year ended 30 June 2021 and prepare the necessary journal entries to record movements in the deferred tax accounts. (10 marks)

2021 $ 2020 $ Assets Cash Accounts receivable Allowance for doubtful debts Inventory Prepaid Rent Machinery Less: Accumulated depreciation Development costs Less: Accumulated amortisation Deferred tax asset 78,400 77,000 (11,480) 50,400 10,220 168,000 (100,800) 126,000 (63,000) ? 0 0 26.600 70,000 19,600 95,200 64,400 (8,260) 40,600 11,900 231,000 (105,000) 112,000 (28,000) 17,010 0 0 23,800 70,000 17,640 Liabilities Accounts payable Borrowings Interest revenue received in advance Provision for annual leave Deferred tax liability 18,480 ? 16,800 28,770 2021 $ 2020 $ Assets Cash Accounts receivable Allowance for doubtful debts Inventory Prepaid Rent Machinery Less: Accumulated depreciation Development costs Less: Accumulated amortisation Deferred tax asset 78,400 77,000 (11,480) 50,400 10,220 168,000 (100,800) 126,000 (63,000) ? 0 0 26.600 70,000 19,600 95,200 64,400 (8,260) 40,600 11,900 231,000 (105,000) 112,000 (28,000) 17,010 0 0 23,800 70,000 17,640 Liabilities Accounts payable Borrowings Interest revenue received in advance Provision for annual leave Deferred tax liability 18,480 ? 16,800 28,770

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts