Question: Question 2: The IS-LM model with sticky prices Consider a closed economy with sticky prices and an efficient term structure of in- terest rates: y

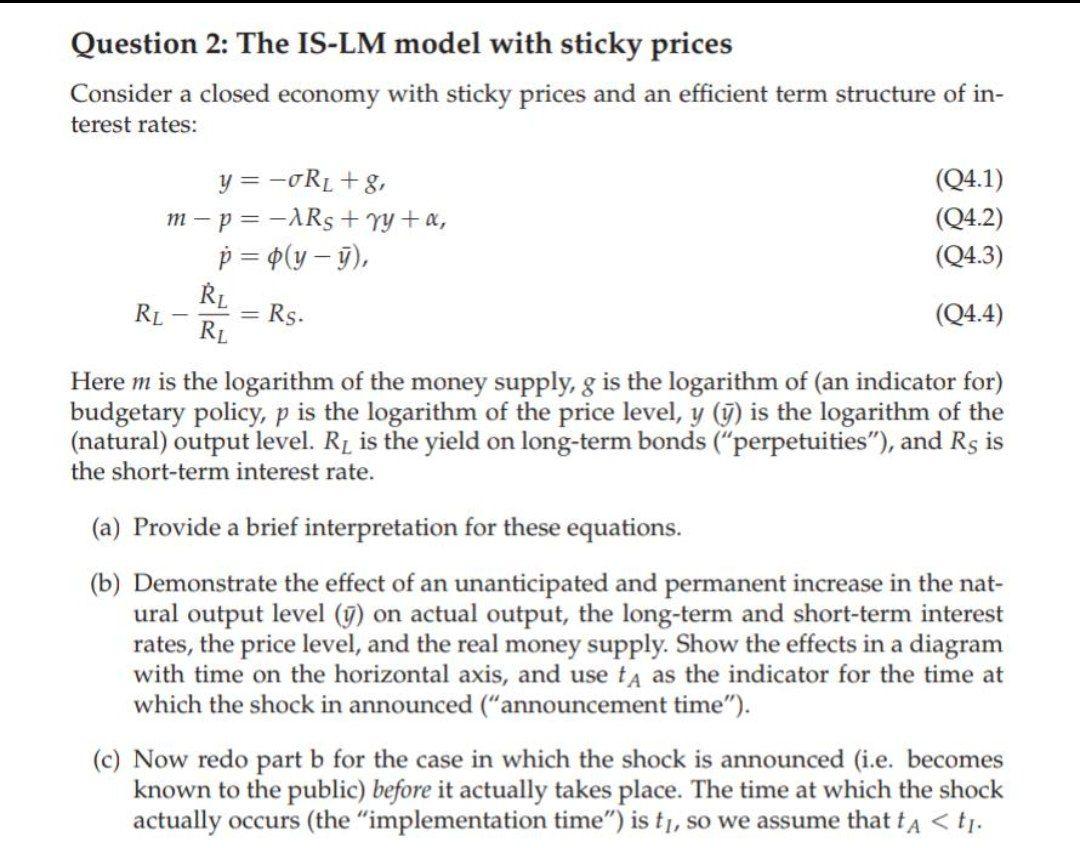

Question 2: The IS-LM model with sticky prices Consider a closed economy with sticky prices and an efficient term structure of in- terest rates: y = -oRL +8, m - p = -ARS + y +, p = $(g-y), (4.1) (Q4.2) (Q4.3) RL RL RL Rs. (Q4.4) Here m is the logarithm of the money supply, g is the logarithm of (an indicator for) budgetary policy, p is the logarithm of the price level, y () is the logarithm of the (natural) output level. RL is the yield on long-term bonds (perpetuities"), and Rs is the short-term interest rate. (a) Provide a brief interpretation for these equations. (b) Demonstrate the effect of an unanticipated and permanent increase in the nat- ural output level (y) on actual output, the long-term and short-term interest rates, the price level, and the real money supply. Show the effects in a diagram with time on the horizontal axis, and use tA as the indicator for the time at which the shock in announced ("announcement time"). (C) Now redo part b for the case in which the shock is announced (i.e. becomes known to the public) before it actually takes place. The time at which the shock actually occurs (the "implementation time") is tj, so we assume that tA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts