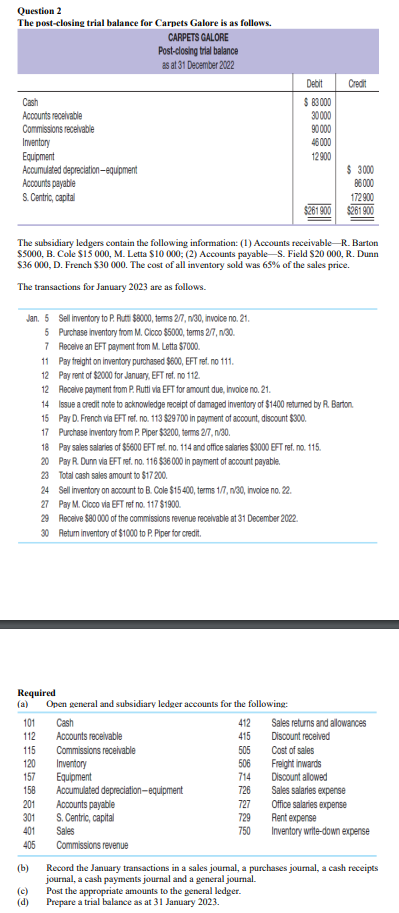

Question: Question 2 The post - closing trial balance for Carpets Galore i s a s follows. Carpets Galore Post - closing trial balance a s

Question

The postclosing trial balance for Carpets Galore follows.

Carpets Galore

Postclosing trial balance

December

Debit Credit

Cash $

Accounts receivable

Commissions receivable

Inventory

Equipment

Accumulated depreciation equipment $

Accounts payable $

Centric, capital $

Total $ $

The subsidiary ledgers contain the following information:

Accounts receivable Barton $ Cole $ Letta $

Accounts payable Field $ Dunn $ French $

The cost all inventory sold was the sales price.

The transactions for January are follows:

Transactions for January

Jan. Sell inventory Rutti $ terms invoice

Jan. Purchase inventory from Cicco $ terms

Jan. Receive EFT payment from Letta $

Jan. Pay freight inventory purchased $ EFT ref.

Jan. Pay rent $ for January, EFT ref.

Jan. Receive payment from Rutti via EFT amount due, invoice

Jan. Issue a credit note acknowledge receipt damaged inventory $ returned Barton.

Jan. Pay French via EFT ref. $ payment account, discount $

Jan. Purchase inventory from Piper $ terms

Jan. Pay sales salaries $ EFT ref. and office salaries $ EFT ref.

Jan. Pay Dunn via EFT ref. $ payment account payable.

Jan. Receive EFT from Cicco full payment $

Jan. Write off account Cole $ terms invoice

Jan. Receive $ the commissions revenue receivable December

Jan. Return inventory $ Piper for credit.

Required

Open general and subsidiary ledger accounts for the following:

Account Number Account Name

Cash

Accounts receivable

Commissions receivable

Inventory

Equipment

Accumulated depreciation equipment

Accounts payable

Centric, capital

Sales

Commissions revenue

Sales returns and allowances

Discount received

Cost sales

Freight inwards

Discount allowed

Sales salaries expense

Office salaries expense

Rent expense

Inventory writedown expense

Record the January transactions a sales journal, a purchases journal, a cash receipts journal, a cash payments journal, and a general journal.

Post the appropriate amounts the general ledger.

Prepare a trial balance January

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock