Question: Question 2 The Public Securities Association (PSA) Prepayment Model has become the industry standard. Create a copy of the worksheet from question 1 and modify

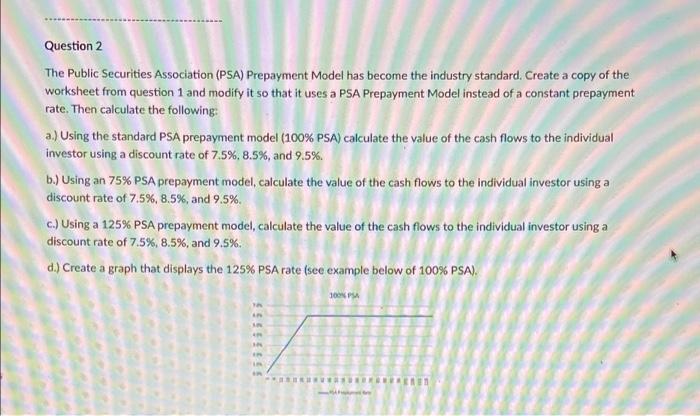

Question 2 The Public Securities Association (PSA) Prepayment Model has become the industry standard. Create a copy of the worksheet from question 1 and modify it so that it uses a PSA Prepayment Model instead of a constant prepayment rate. Then calculate the following: a.) Using the standard PSA prepayment model (100% PSA) calculate the value of the cash flows to the individual investor using a discount rate of 7.5%, 8.5%, and 9.5% b.) Using an 75% PSA prepayment model, calculate the value of the cash flows to the individual investor using a discount rate of 7.5%, 8.5%, and 9.5%. c.) Using a 125% PSA prepayment model, calculate the value of the cash flows to the individual investor using a discount rate of 7.5%, 8.5%, and 9.5%. d.) Create a graph that displays the 125% PSA rate (see example below of 100% PSA). 100 PM Question 2 The Public Securities Association (PSA) Prepayment Model has become the industry standard. Create a copy of the worksheet from question 1 and modify it so that it uses a PSA Prepayment Model instead of a constant prepayment rate. Then calculate the following: a.) Using the standard PSA prepayment model (100% PSA) calculate the value of the cash flows to the individual investor using a discount rate of 7.5%, 8.5%, and 9.5% b.) Using an 75% PSA prepayment model, calculate the value of the cash flows to the individual investor using a discount rate of 7.5%, 8.5%, and 9.5%. c.) Using a 125% PSA prepayment model, calculate the value of the cash flows to the individual investor using a discount rate of 7.5%, 8.5%, and 9.5%. d.) Create a graph that displays the 125% PSA rate (see example below of 100% PSA). 100 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts