Question: QUESTION 2 The subject property is a warehouse that is 5 0 feet by 2 0 0 feet by 1 6 feet high. The warehouse

QUESTION

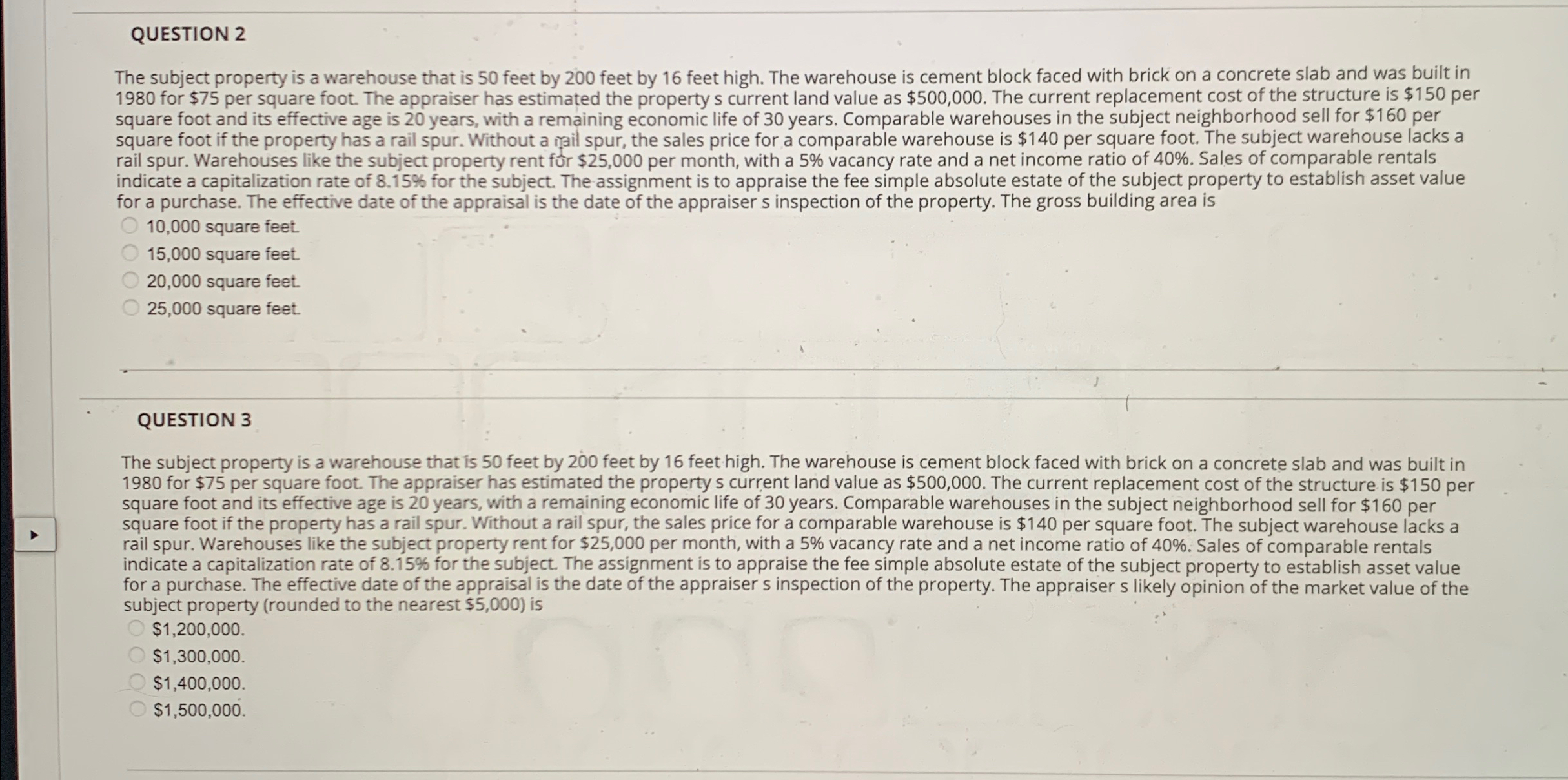

The subject property is a warehouse that is feet by feet by feet high. The warehouse is cement block faced with brick on a concrete slab and was built in for $ per square foot. The appraiser has estimated the property s current land value as $ The current replacement cost of the structure is $ per square foot and its effective age is years, with a remaining economic life of years. Comparable warehouses in the subject neighborhood sell for $ per square foot if the property has a rail spur. Without a igail spur, the sales price for a comparable warehouse is $ per square foot. The subject warehouse lacks a rail spur. Warehouses like the subject property rent fr $ per month, with a vacancy rate and a net income ratio of Sales of comparable rentals indicate a capitalization rate of for the subject. The assignment is to appraise the fee simple absolute estate of the subject property to establish asset value for a purchase. The effective date of the appraisal is the date of the appraiser s inspection of the property. The gross building area is

square feet.

square feet.

square feet.

square feet.

QUESTION

The subject property is a warehouse that is feet by feet by feet high. The warehouse is cement block faced with brick on a concrete slab and was built in for $ per square foot. The appraiser has estimated the property s current land value as $ The current replacement cost of the structure is $ per square foot and its effective age is years, with a remaining economic life of years. Comparable warehouses in the subject neighborhood sell for $ per square foot if the property has a rail spur. Without a rail spur, the sales price for a comparable warehouse is $ per square foot. The subject warehouse lacks a rail spur. Warehouses like the subject property rent for $ per month, with a vacancy rate and a net income ratio of Sales of comparable rentals indicate a capitalization rate of for the subject. The assignment is to appraise the fee simple absolute estate of the subject property to establish asset value for a purchase. The effective date of the appraisal is the date of the appraiser s inspection of the property. The appraiser s likely opinion of the market value of the subject property rounded to the nearest $ is

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock