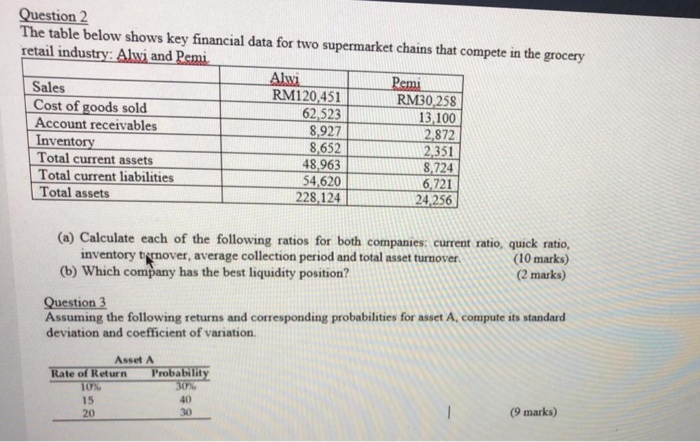

Question: Question 2 The table below shows key financial data for two supermarket chains that compete in the grocery retail industry: Alwi and Pemi Alwi Pemi

Question 2 The table below shows key financial data for two supermarket chains that compete in the grocery retail industry: Alwi and Pemi Alwi Pemi Sales RM120,451 RM30,258 Cost of goods sold 62 523 13.100 Account receivables 8.927 2,872 Inventory 8,652 2,351 Total current assets 48,963 8.724 Total current liabilities 54,620 6,721 Total assets 228,124 24,256 (a) Calculate each of the following ratios for both companies: current ratio, quick ratio, inventory tirnover, average collection period and total asset turnover. (10 marks) (b) Which company has the best liquidity position? (2 marks) Question 3 Assuming the following returns and corresponding probabilities for asset A, compute its standard deviation and coefficient of variation Asset A Rate of Return Probability TUX 15 40 20 30 30% (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts