Question: Question 2: The trinomial method is a simple extension of the binomial method. In the trinomial method, we denote the value of the underlying asset

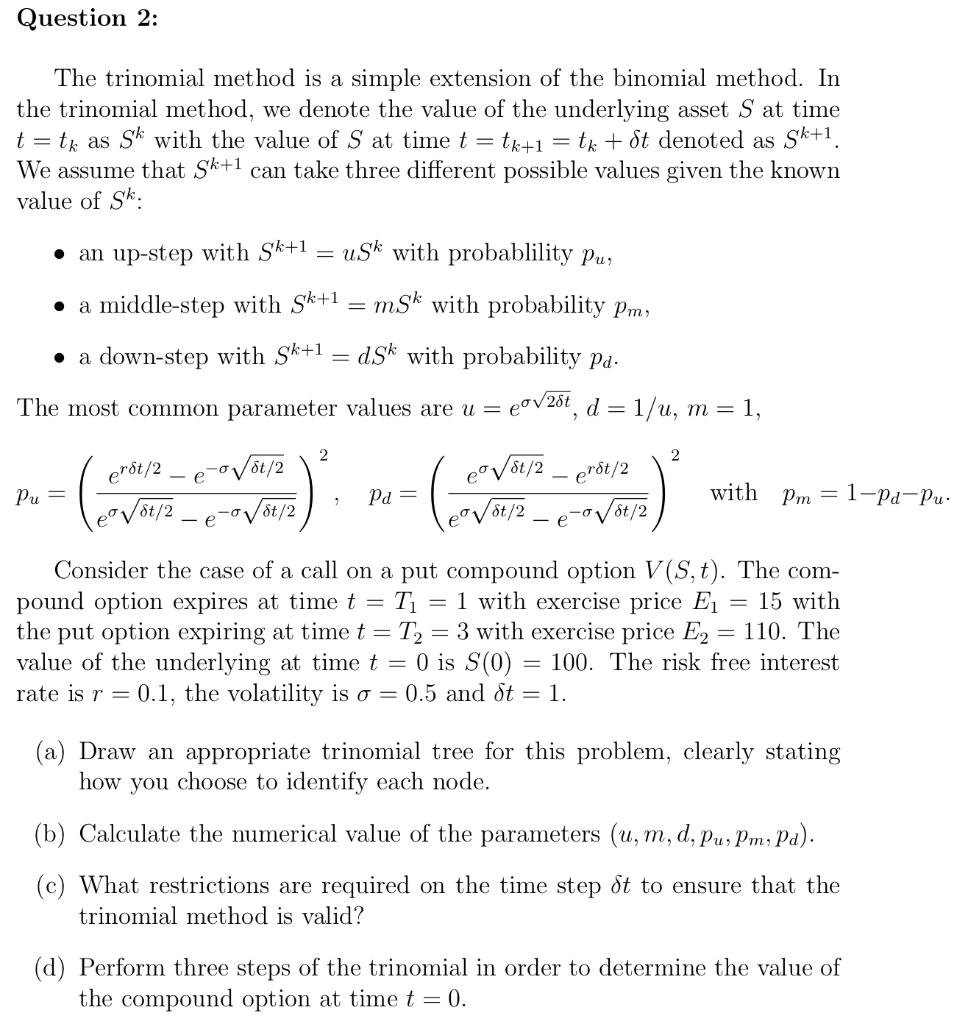

Question 2: The trinomial method is a simple extension of the binomial method. In the trinomial method, we denote the value of the underlying asset S at time t = tk as Sk with the value of S at time t = tk+1 = tk + St denoted as Sk+1. We assume that Sk+1 can take three different possible values given the known value of sk: an up-step with Sk+1 = usk with probablility Pu, a middle-step with Sk+1 = mSk with probability Pm, a down-step with Sk+1 = d.sk with probability pa. The most common parameter values are u = pov28t, d=1/u, m= 1, 7 2 2 er 8t/2 - e o v t/2 erot/2 -t/2 Pu= Pa = with Pm = 1-Pa-Pu. 8t/2 e - st/2 le Vt/2 e -ovot/2 Consider the case of a call on a put compound option V(S,t). The com- pound option expires at time t = T1 = 1 with exercise price Ei = 15 with the put option expiring at time t = T2 = 3 with exercise price E2 = 110. The value of the underlying at time t = 0) is S(0) 100. The risk free interest rate is r = 0.1, the volatility is o = 0.5 and dt = 1. = (a) Draw an appropriate trinomial tree for this problem, clearly stating how you choose to identify each node. (b) Calculate the numerical value of the parameters (u, m, d, Pu, Pm, pa). (c) What restrictions are required on the time step St to ensure that the trinomial method is valid? (d) Perform three steps of the trinomial in order to determine the value of the compound option at time t = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts