Question: Question 2 : The Zero Lower Bound 1 ) Plot since 2 0 0 0 the nominal interest rate on the Japanese long - term

Question : The Zero Lower Bound

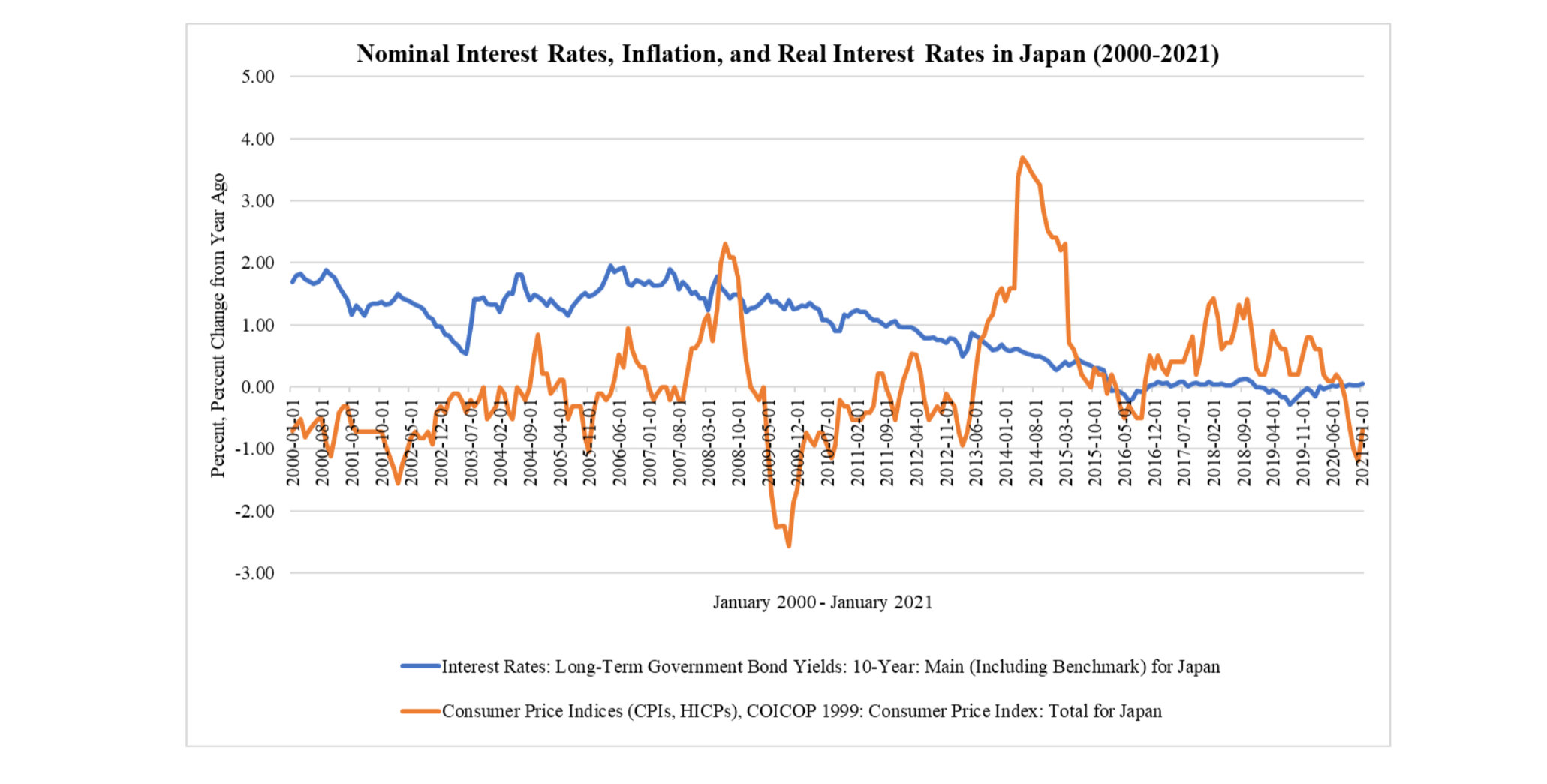

Plot since the nominal interest rate on the Japanese longterm yeargovernment bond FRED code: IRLTLTJPMNthe inflation rate based on the percentage change from a year ago of the Japan's consumer price index FRED code: JPNCIALLMINMEI, and then plot the estimated value of the real interest rate based on the difference between these two abovementioned indicators.

Comment on the lengthy period of the positive real rates since and the role of deflation in determining the real rate. Discuss the risks that the deflation poses in an economy with the nominal interest rate at the zero lower bound.

Could you help me answer question based on the graph? Nominal Interest Rates, Inflation, and Real Interest Rates in Japan

qquad

Interest Rates: LongTerm Government Bond Yields: Year: Main Including Benchmark for Japan

Consumer Price Indices CPIs HICPs COICOP : Consumer Price Index: Total for Japan

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock