Question: QUESTION 2 - This question has THREE parts (a), (b), and (c). Emma is a freelance graphic designer with an annual income of $85,000. She

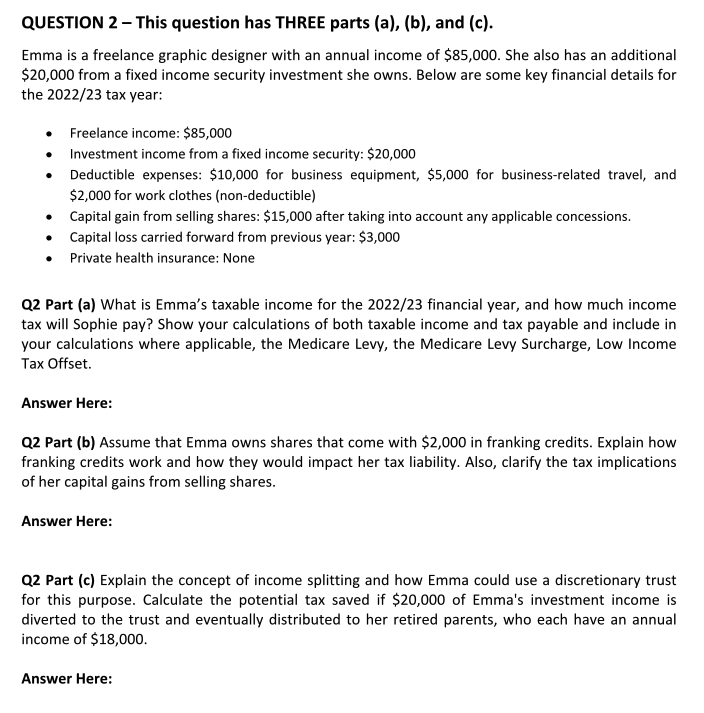

QUESTION 2 - This question has THREE parts (a), (b), and (c). Emma is a freelance graphic designer with an annual income of $85,000. She also has an additional $20,000 from a fixed income security investment she owns. Below are some key financial details for the 2022/23 tax year: - Freelance income: $85,000 - Investment income from a fixed income security: $20,000 - Deductible expenses: $10,000 for business equipment, $5,000 for business-related travel, and $2,000 for work clothes (non-deductible) - Capital gain from selling shares: $15,000 after taking into account any applicable concessions. - Capital loss carried forward from previous year: $3,000 - Private health insurance: None Q2 Part (a) What is Emma's taxable income for the 2022/23 financial year, and how much income tax will Sophie pay? Show your calculations of both taxable income and tax payable and include in your calculations where applicable, the Medicare Levy, the Medicare Levy Surcharge, Low Income Tax Offset. Answer Here: Q2 Part (b) Assume that Emma owns shares that come with $2,000 in franking credits. Explain how franking credits work and how they would impact her tax liability. Also, clarify the tax implications of her capital gains from selling shares. Answer Here: Q2 Part (c) Explain the concept of income splitting and how Emma could use a discretionary trust for this purpose. Calculate the potential tax saved if $20,000 of Emma's investment income is diverted to the trust and eventually distributed to her retired parents, who each have an annual income of $18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts