Question: Question 2 (this question has two parts, (a) & (b)) (a) Suppose the following table illustrates the values of real and potential GDP and the

Question 2 (this question has two parts, (a) & (b))

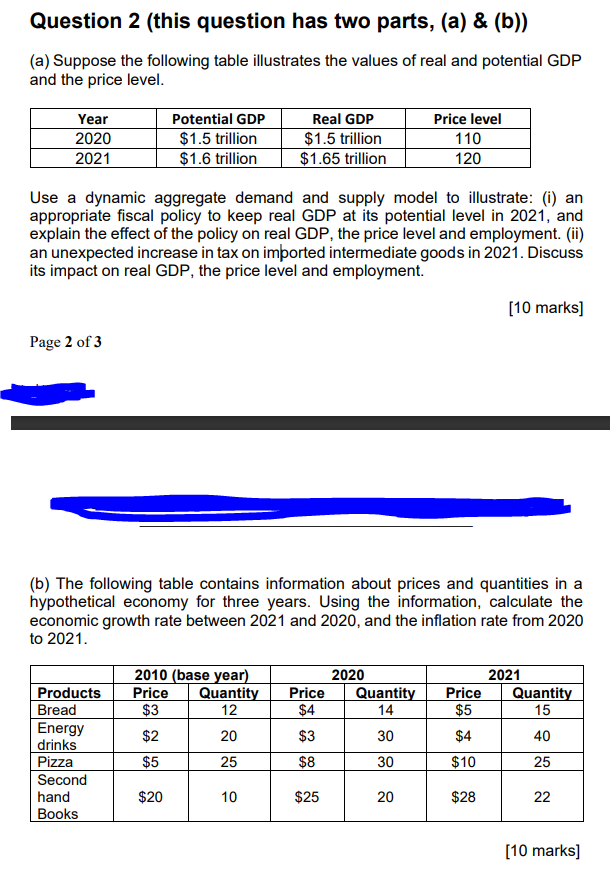

(a) Suppose the following table illustrates the values of real and potential GDP and the price level.

Use a dynamic aggregate demand and supply model to illustrate: (i) an appropriate fiscal policy to keep real GDP at its potential level in 2021, and explain the effect of the policy on real GDP, the price level and employment. (ii) an unexpected increase in tax on imported intermediate goods in 2021. Discuss its impact on real GDP, the price level and employment.

(b) The following table contains information about prices and quantities in a hypothetical economy for three years. Using the information, calculate the economic growth rate between 2021 and 2020, and the inflation rate from 2020 to 2021.

Question 2 (this question has two parts, (a) \& (b)) (a) Suppose the following table illustrates the values of real and potential GDP and the price level. Use a dynamic aggregate demand and supply model to illustrate: (i) an appropriate fiscal policy to keep real GDP at its potential level in 2021, and explain the effect of the policy on real GDP, the price level and employment. (ii) an unexpected increase in tax on imported intermediate goods in 2021. Discuss its impact on real GDP, the price level and employment. [10 marks] Page 2 of 3 (b) The following table contains information about prices and quantities in a hypothetical economy for three years. Using the information, calculate the economic growth rate between 2021 and 2020, and the inflation rate from 2020 to 2021. [10 marks ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts