Question: Question 2. This question is compulsory L Co issues 4,000 convertible bonds on 1 January 2019 at par. The bond is redeemable 3 years later

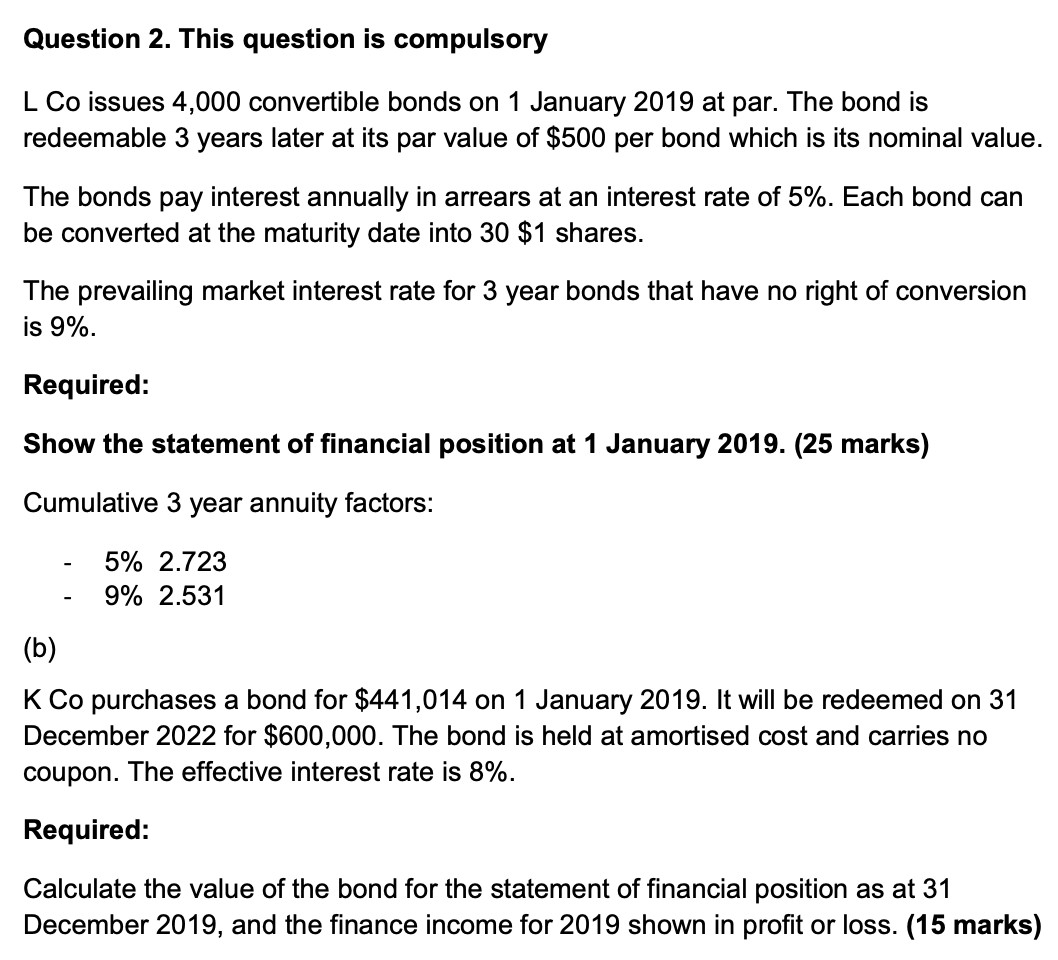

Question 2. This question is compulsory L Co issues 4,000 convertible bonds on 1 January 2019 at par. The bond is redeemable 3 years later at its par value of $500 per bond which is its nominal value. The bonds pay interest annually in arrears at an interest rate of 5%. Each bond can be converted at the maturity date into 30 $1 shares. The prevailing market interest rate for 3 year bonds that have no right of conversion is 9%. Required: Show the statement of financial position at 1 January 2019. (25 marks) Cumulative 3 year annuity factors: 5% 2.723 9% 2.531 (b) K Co purchases a bond for $441,014 on 1 January 2019. It will be redeemed on 31 December 2022 for $600,000. The bond is held at amortised cost and carries no coupon. The effective interest rate is 8%. Required: Calculate the value of the bond for the statement of financial position as at 31 December 2019, and the finance income for 2019 shown in profit or loss. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts