Question: Beale Ltd is a small services company that has been in operation for 5 years. It has 5 employees, all of whom have been

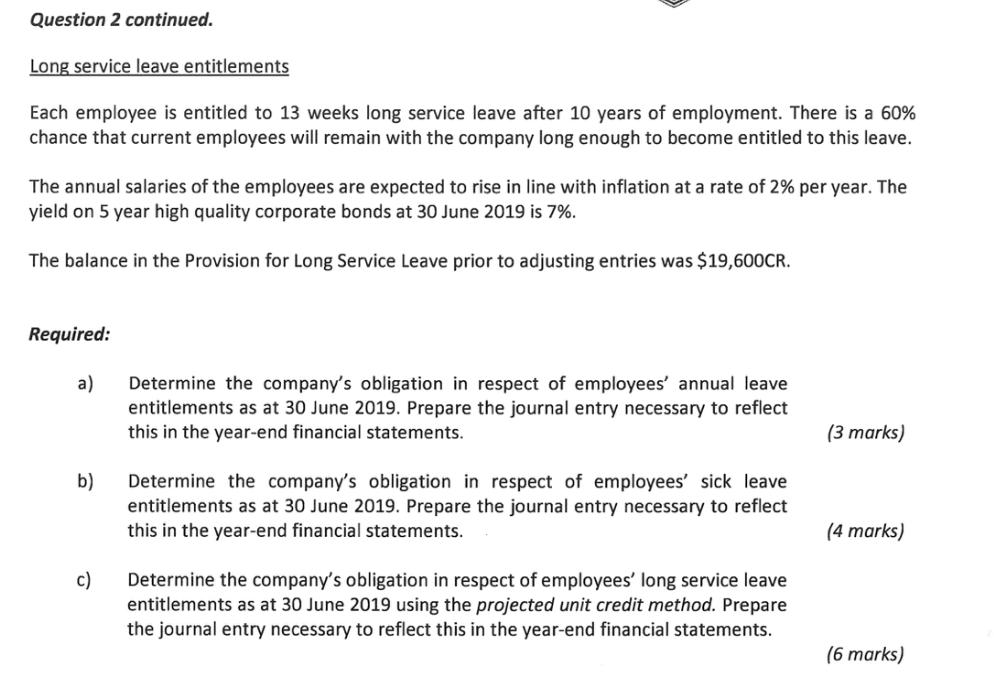

Beale Ltd is a small services company that has been in operation for 5 years. It has 5 employees, all of whom have been with the company since it started operations. At year end (30 June), the company measures any obligations it has in respect of employee benefits in accordance with AASB119 Employee Benefits. The following information has been extracted from the payroll and personnel records of the company. The daily pay per employee is $200 and the annual salary per employee is $52,000. Annual leave entitlements Each employee is entitled to 20 days annual leave per year, along with a loading of 17.5% when the leave is taken. Annual leave entitlements are accumulating and vesting. At 1 July 2018, the 5 employees had a total of 70 days accrued leave. During the year, they took 105 days leave. At 30 June 2019, the balance in the Provision for Annual Leave prior to adjusting entries was $8,575 DR. All annual leave accumulated at 30 June 2019 is expected to be taken within the following year. Sick leave entitlements Each employee is entitled to 10 days sick leave per year. This leave is accumulating and non-vesting. At 1 July 2018, the 5 employees had a total of 38 days accrued sick leave. During the year, they took 24 days leave. At 30 June 2019, the balance in the Provision for Sick Leave prior to adjusting entries was $2,200 CR. It is expected that 40% of the sick leave accumulated at 30 June 2019 will be taken within the following year, 15% will be taken in the year after that, and the remaining 45% will not be taken at all. The yield on 1 year high quality corporate bonds at 30 June 2019 is 5%. Question 2 continued. Long service leave entitlements Each employee is entitled to 13 weeks long service leave after 10 years of employment. There is a 60% chance that current employees will remain with the company long enough to become entitled to this leave. The annual salaries of the employees are expected to rise in line with inflation at a rate of 2% per year. The yield on 5 year high quality corporate bonds at 30 June 2019 is 7%. The balance in the Provision for Long Service Leave prior to adjusting entries was $19,600CR. Required: a) b) c) Determine the company's obligation in respect of employees' annual leave entitlements as at 30 June 2019. Prepare the journal entry necessary to reflect this in the year-end financial statements. Determine the company's obligation in respect of employees' sick leave entitlements as at 30 June 2019. Prepare the journal entry necessary to reflect this in the year-end financial statements. Determine the company's obligation in respect of employees' long service leave entitlements as at 30 June 2019 using the projected unit credit method. Prepare the journal entry necessary to reflect this in the year-end financial statements. (3 marks) (4 marks) (6 marks)

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Based on the scenario the answers for the required questions are as follows a The companys obligation in respect of employees annual leave entitlements as of 30 June 2019 is 9075 This is calculated as follows Balance in Provision for Annual Leave before adjusting entries 8575 DR Less Annual leave taken during the year 10500 200 per day x 105 days Add Provision for annual leave expected to be taken in the following year 11600 200 per day x 20 days x 5 employees x 1175 loadings Total obligation 9075 The journal entry necessary to reflect this in the yearend financial statements would be Dr Employee Benefits Expense 9075 Cr Provision for Annual Leave 9075 b The companys obligation in respect of employees sick leave entitlements as of 30 June 2019 is 2358 This is calculated as follows Balance in Provision for Sick Leave before adjusting entries 2200 CR Less Sick leave taken during the year 4800 200 per day x 24 days Add Provision for sick leave expected to be taken in the following year 1520 200 per day x 10 days x 5 employees x 04 Add Provision for sick leave expected to be taken in the year after that 570 200 per day x 10 days x 5 employees x 015 Total obligation 2358 The journal entry necessary to reflect this in the yearend financial statements would be Dr Employee Benefits Expense 2358 Cr Provision for Sick Leave 2358 c The companys obligation in respect of employees long service leave entitlements as of 30 June 2019 using the projected unit credit method is 12271 This is calculated as follows Present value of expected future long service leave payments 18190 Less Fair value of plan assets assuming no plan assets have been set aside 0 Obligation before adjusting entries 18190 Less Obligation relating to past service assuming no past service has been recognized 0 Obligation as at 30 June 2019 18190 To calculate the present value of expected future long service leave payments the following formula is used PV L x 1in A x 1in 1i where PV present value of expected future long service leave payments L expected future long service leave payments i discount rate 7 n number of years until the long service leave entitlement ... View full answer

Get step-by-step solutions from verified subject matter experts