Question: Question 2 (Total 15 marks) A) Suppose that Bank A offers you a deposit account of interest at 10% per annum, interest is compounded and

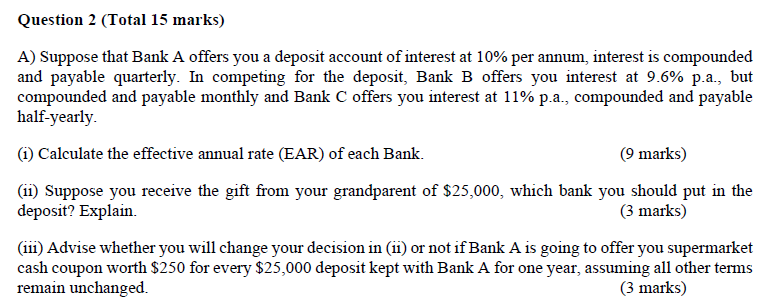

Question 2 (Total 15 marks) A) Suppose that Bank A offers you a deposit account of interest at 10% per annum, interest is compounded and payable quarterly. In competing for the deposit, Bank B offers you interest at 9.6% p.a., but compounded and payable monthly and Bank C offers you interest at 11% p.a., compounded and payable half-yearly (1) Calculate the effective annual rate (EAR) of each Bank. (9 marks) (11) Suppose you receive the gift from your grandparent of $25,000, which bank you should put in the deposit? Explain. (3 marks) (111) Advise whether you will change your decision in (ii) or not if Bank A is going to offer you supermarket cash coupon worth $250 for every $25,000 deposit kept with Bank A for one year, assuming all other terms remain unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts