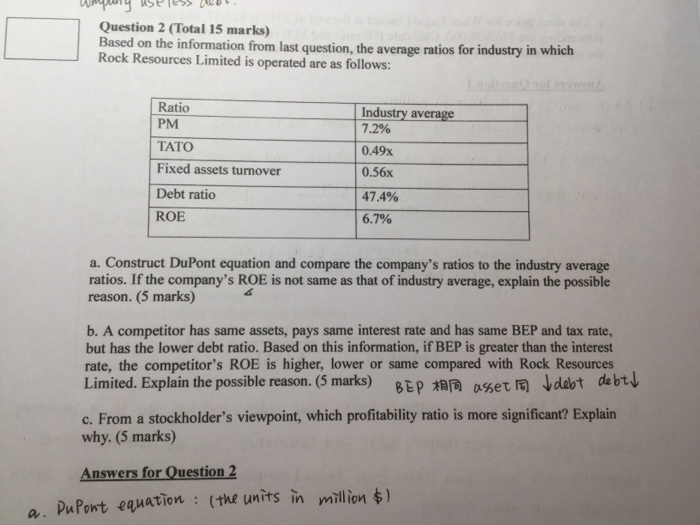

Question: Question 2 (Total 15 marks) Based on the information from last question, the average ratios for industry in which Rock Resources Limited is operated are

Question 2 (Total 15 marks) Based on the information from last question, the average ratios for industry in which Rock Resources Limited is operated are as follows: Ratio PM TATO Fixed assets turnover Debt ratio ROE I industry average 7.2% 0.49x 0.56x 47.4% 67% a. Construct DuPont equation and compare the company's ratios to the industry average ratios. If the company's ROE is not same as that of industry average, explain the possible reason. (5 marks) b. A competitor has same assets, pays same interest rate and has same BEP and tax rate, but has the lower debt ratio. Based on this information, if BEP is greater than the interest rate, the competitor's ROE is higher, lower or same compared with Rock Resources Limited. Explain the possible reason. (5 marks) BEPasset debt debtu c. From a stockholder's viewpoint, which profitability ratio is more significant? Explain why. (5 marks) Answers for Question 2 a. PuPont eauation : (the units in million $) Question 2 (Total 15 marks) Based on the information from last question, the average ratios for industry in which Rock Resources Limited is operated are as follows: Ratio PM TATO Fixed assets turnover Debt ratio ROE I industry average 7.2% 0.49x 0.56x 47.4% 67% a. Construct DuPont equation and compare the company's ratios to the industry average ratios. If the company's ROE is not same as that of industry average, explain the possible reason. (5 marks) b. A competitor has same assets, pays same interest rate and has same BEP and tax rate, but has the lower debt ratio. Based on this information, if BEP is greater than the interest rate, the competitor's ROE is higher, lower or same compared with Rock Resources Limited. Explain the possible reason. (5 marks) BEPasset debt debtu c. From a stockholder's viewpoint, which profitability ratio is more significant? Explain why. (5 marks) Answers for Question 2 a. PuPont eauation : (the units in million $)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts