Question: Question 2 ( Total 2 0 marks ) Presented below are the year - end balances at December 3 1 of Fast Forward. ( All

Question Total marks

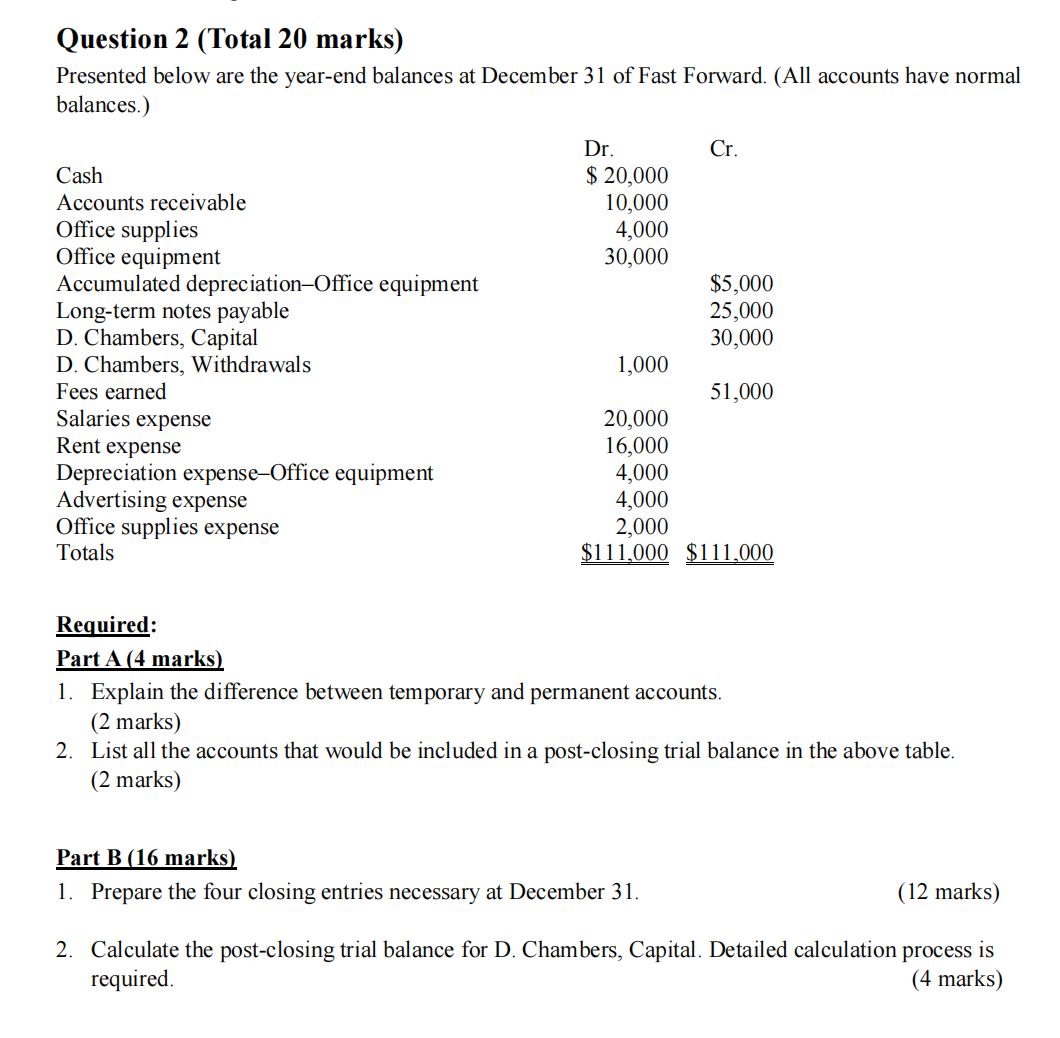

Presented below are the yearend balances at December of Fast Forward. All accounts have normal balances.

tableDrCrCash$ Accounts receivable,Office supplies,Office equipment,Accumulated depreciationOffice equipment,,$Longterm notes payable,,D Chambers, Capital,,D Chambers, Withdrawals,Fees earned,,Salaries expense,Rent expense,Depreciation expenseOffice equipment,Advertising expense,Office supplies expense,Totals$$

Required:

Part A marks

Explain the difference between temporary and permanent accounts.

marks

List all the accounts that would be included in a postclosing trial balance in the above table. marks

Part B marks

Prepare the four closing entries necessary at December

marks

Calculate the postclosing trial balance for D Chambers, Capital. Detailed calculation process is required.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock