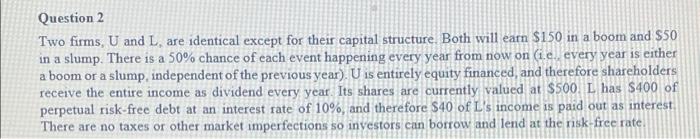

Question: Question 2 Two firms, U and L. are identical except for their capital structure. Both will earn $150 in a boom and $50 in a

Question 2 Two firms, U and L. are identical except for their capital structure. Both will earn $150 in a boom and $50 in a slump. There is a 50% chance of each event happening every year from now on i.e. every year is either a boom or a slump, independent of the previous year). U is entirely equity financed, and therefore shareholders receive the entire income as dividend every year. Its shares are currently valued at $500. L has $400 of perpetual risk-free debt at an interest rate of 10%, and therefore $40 of L's income is paid out as interest There are no taxes or other market imperfections so investors can borrow and lend at the risk-free rate (d) Show that M&M's proposition II holds for your answer to partc (ie., show that the relationship between the expected returns of your investments with identical payoffs is the one predicted by proposition II)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts