Question: Question (2): Use the following data and information to determine the best cholce of the following statements from no. 7 to no. 22 : On

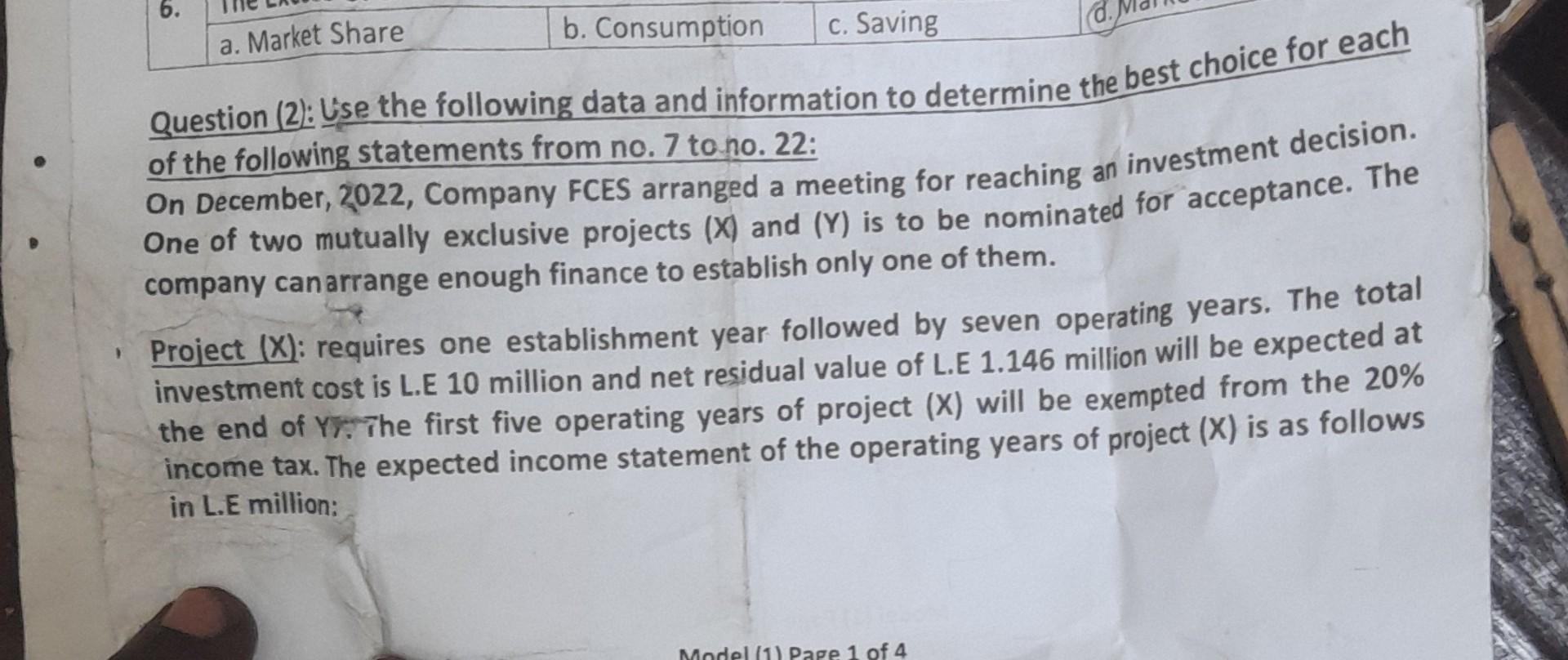

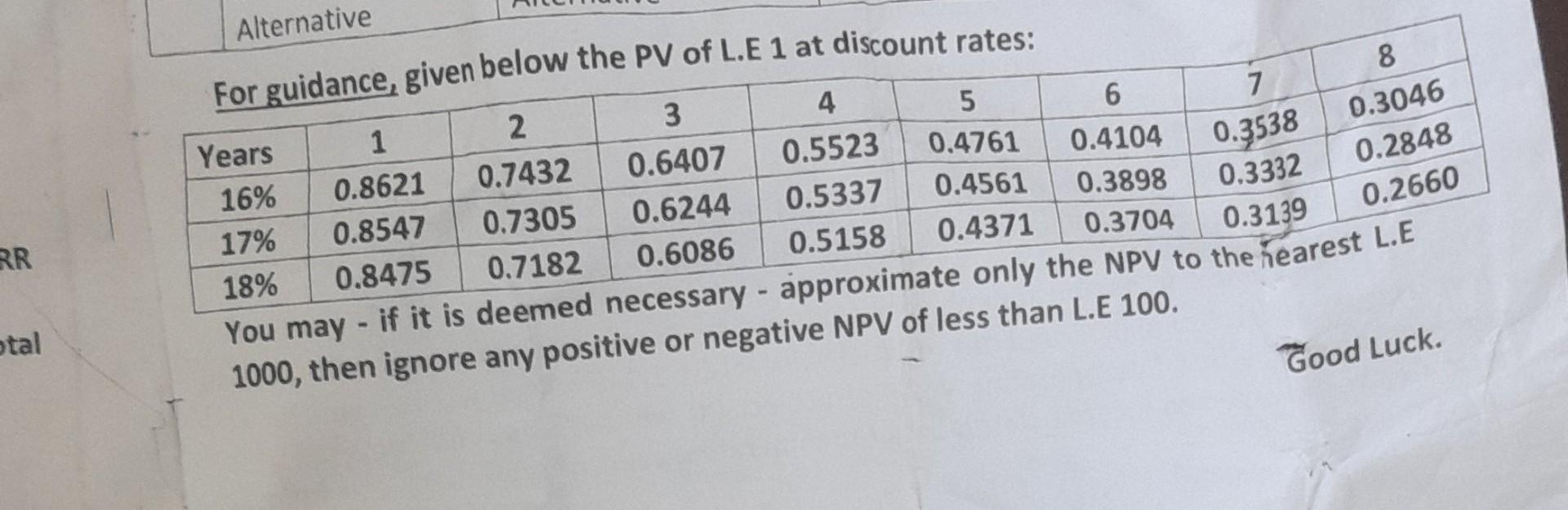

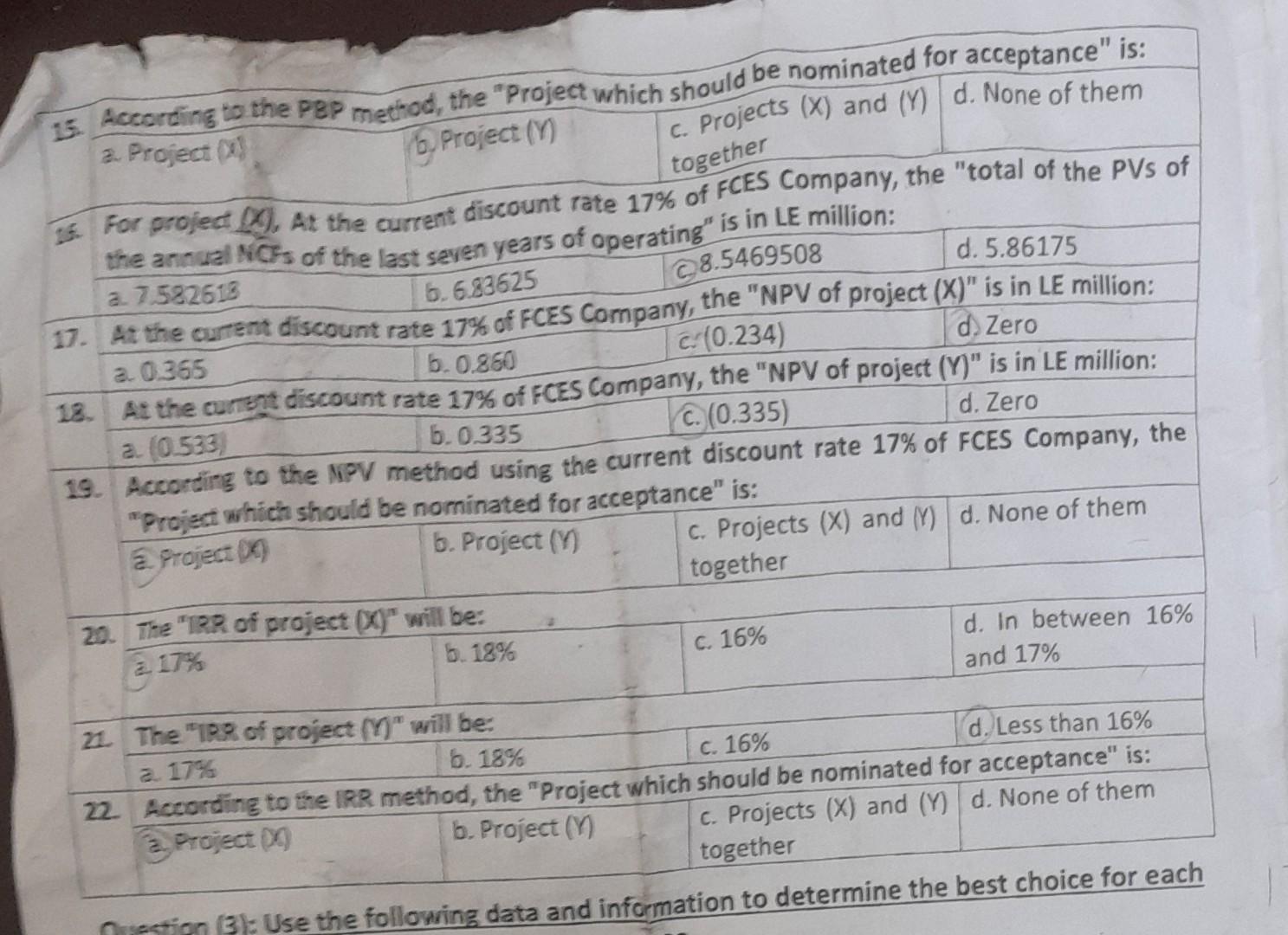

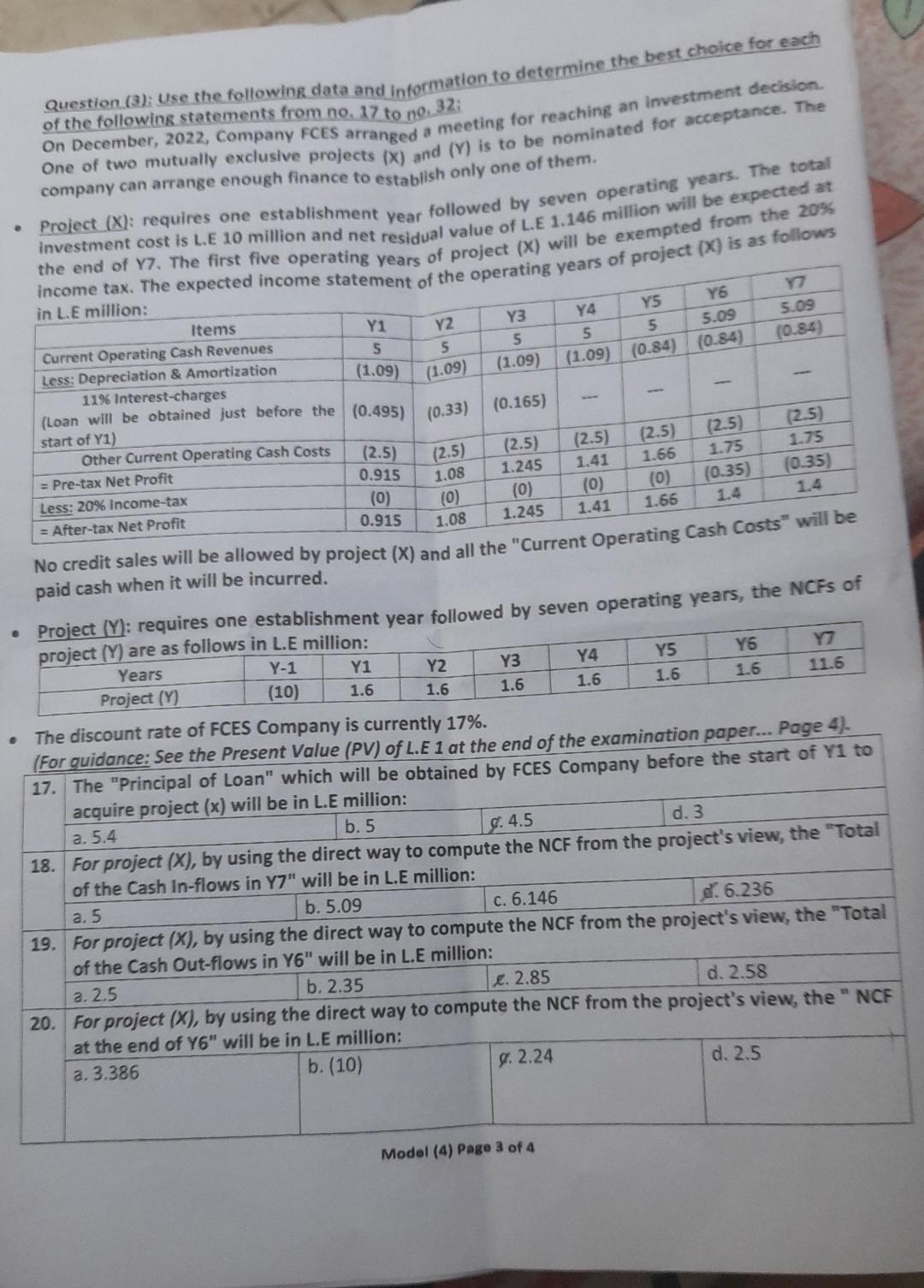

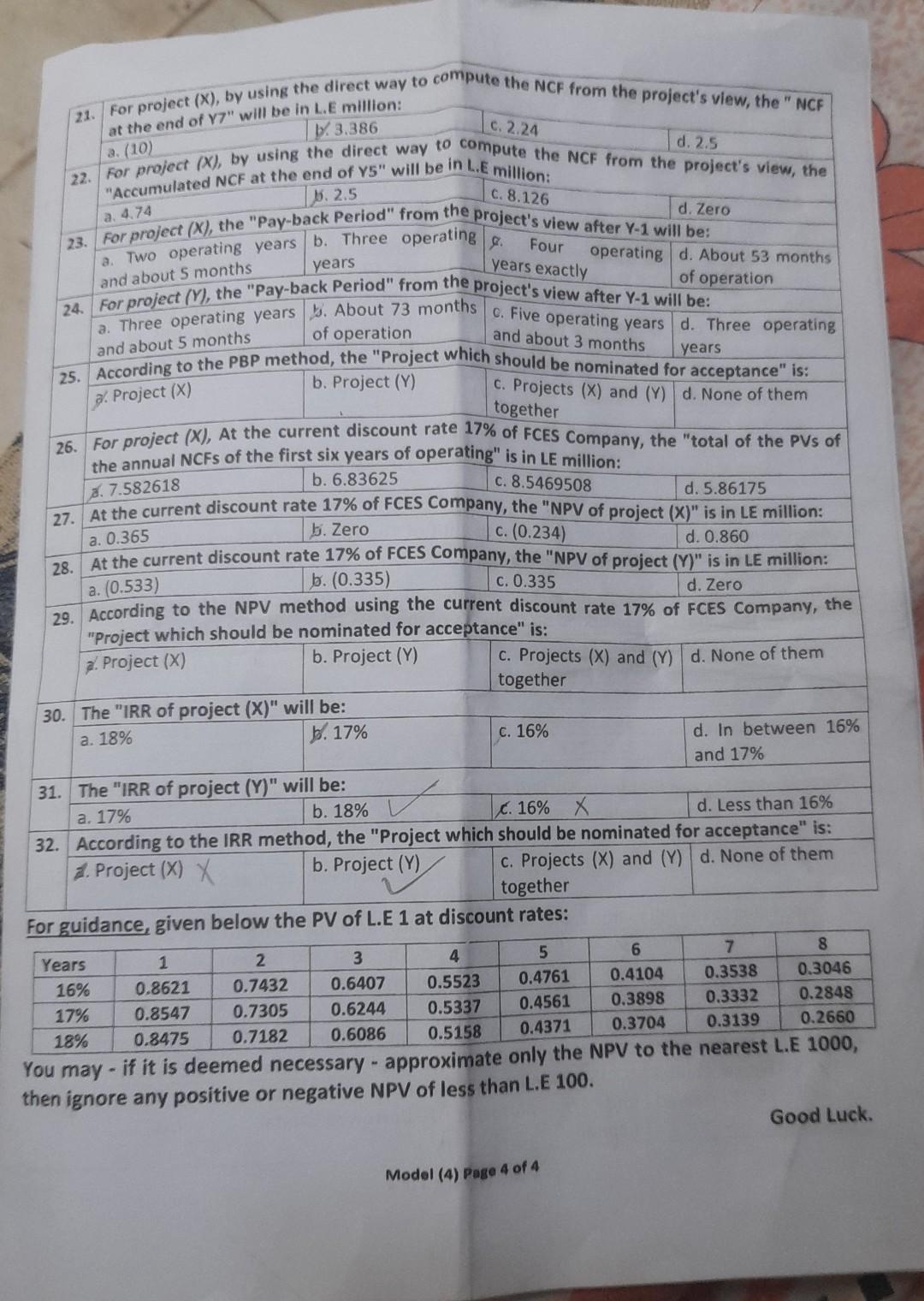

Question (2): Use the following data and information to determine the best cholce of the following statements from no. 7 to no. 22 : On December, 2022, Company FCES arranged a meeting for reaching an investment decision. One of two mutually exclusive projects (X) and (Y) is to be nominated for acceptance. The company canarrange enough finance to establish only one of them. Project (X) : requires one establishment year followed by seven operating years. The total investment cost is L.E 10 million and net residual value of L.E 1.146 million will be expected at the end of Yr.The first five operating years of project (X) will be exempted from the 20% income tax. The expected income statement of the operating years of project (X) is as follows in L.E million: Alternative 1000 , then ignore any positive or negative NPV of less than L.E 100. 35. For project (X), At the current discount rate 17% of F the annual NCF S of the last seven years of operating" is in LE million: a. 7.582618 b. 6.83625 \begin{tabular}{l|l|l|} \hline C 8.5469508 & d. 5.86175 \\ \hline \end{tabular} a. 0.365 b. 0.880 c. (0.234) d. Zero a. (0.533) b. 0.335 c. (0.335) 19. According to the MiPV method using the current discount rate 17% of FCES Company, the "Project which should be nominated for acceptance" is: . Project (0) b. Project (V) c. Projects (X) and (Y) d. None of them together 20. The "12R of project (X)n will be: b. 18% c. 16% d. In between 16% and 17% 21. The "108 of project (M)n will be: a. 17% b. 18% c. 16% d. Less than 16% 22 . According to the IRR method, the "Project which should be nominated for acceptance" is: a. Project (D) b. Project (M) c. Projects (X) and (Y) d. None of them together Question (3)i Use the following data and information to determine the best choice for each of the following statements from no. 17 to no. 32: On December, 2022, Company FCES arranged a meeting for reaching an investment decision. One of two mutually exclusive projects (X) and (Y) is to be nominated for acceptance. The company can arrange enough finance to estabish only one of them. - Project (X) : requires one establishment year followed by seven operating years. The total investment cost is L.E 10 million and net residual value of L.E 1.146 million will be expected at paid cash when it will be incurred. - The discount rate of FCES Company is currently 17%. 17. The "Principal of Loan" which will be obtained by FCES Company before the start of Y1 to acquire project (x) will be in L.E million: a. 5.4 \begin{tabular}{l|l|l|l} & b. 5 & \multicolumn{1}{l|}{ d. 4.5} \\ 18. For project (X), by using the direct way to compute the NCF from the project's view, the "Total \\ of the Cash In-flows in Y7 will be in L.E million: \end{tabular} a. 5 b. 5.09 \begin{tabular}{ll|l|l} & b. 5.09 & c. 6.146 & d. 6.236 \\ 19. For project (X), by using the direct way to compute the NCF from the project's view, the "Total \end{tabular} of the Cash Out-flows in Y6 will be in L.E million: 3. 2.5 b. 2.35 e. 2.85 \begin{tabular}{llll} \hline & b. 2.35 & \&. 2.85 & d. 2.58 \\ \hline \end{tabular} Model (4) Page 3 of 4 21. For project (X), by using the direct way to compute the NCF from the project's view, the " NCF at the end of V7 " will be in L.E million: \begin{tabular}{l|l} 22. (10) \\ 22. For project (X), by using the direct way to compute the NCF from the project's view, the \\ "Accumuled NCF at the end of Y5" will be in L.E million: \end{tabular} "Accumulated NCF at the end of Y5" will be in L.E million: 23. For project (X), the "Pay-back Period" from the project's view after Y-1 will be: \begin{tabular}{|l|l|l|l|l|} \hline a. Two operating years & b. Three operating years & \&. Four operating years exactly & d. About 53 months of operation \end{tabular} For project (Y), the "Pay-back Period" from the project's view after Y-1 will be: and about 5 months of operation and about 3 months years 25. \begin{tabular}{|l|l|l|l|l|} \hline According to the PBP method, the "Project which should be nominated for acceptance" is: \\ \hline g. Project (X) & b. Project (Y) & c. Projects (X) and (Y) together & d. None of them \\ \hline \end{tabular} 26. For project (X), At the current discount rate 17\% of FCES Company, the "total of the PVs of the annual NCFs of the first six years of operating" is in LE million: 3. 7.582618 b. 6.83625 c. 8.5469508 d. 5.86175 27. At the current discount rate 17% of FCES Company, the "NPV of project (X)" is in LE million: a. 0.365 c. (0.234) d. 0.860 28. At the current discount rate 17% of FCES Company, the "NPV of project (Y)" is in LE million: a. (0.533) b. (0.335) c. 0.335 d. Zero 29. According to the NPV method using the current discount rate 17% of FCES Company, the "Project which should be nominated for acceptance" is: a. Project (X) b. Project (Y) c. Projects (X) and (Y) d. None of them together 30. The "IRR of project (X)" will be: a. 18% b. 17% c. 16% d. In between 16% and 17% 31. The "IRR of project (Y)" will be: a. 17% b. 18% c. 16% X \begin{tabular}{l} \begin{tabular}{|l|l|l|} \hline 1. Project (X) X & \multicolumn{1}{|c|}{ d. Less than 16%} \\ \hline \end{tabular} \\ \hline \end{tabular} 32. According to the IRR method, the "Project which should be nominated for acceptance" is: \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Years & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 \\ \hline 16% & 0.8621 & 0.7432 & 0.6407 & 0.5523 & 0.4761 & 0.4104 & 0.3538 & 0.3046 \\ \hline 17% & 0.8547 & 0.7305 & 0.6244 & 0.5337 & 0.4561 & 0.3898 & 0.3332 & 0.2848 \\ \hline 18% & 0.8475 & 0.7182 & 0.6086 & 0.5158 & 0.4371 & 0.3704 & 0.3139 & 0.2660 \\ \hline \end{tabular} You may - if it is deemed necessary - approximate only the NPV to the nearest L.E 1000 , then ignore any positive or negative NPV of less than L.E 100. Good Luck. Model (4) Page 4 of 4 Question (2): Use the following data and information to determine the best cholce of the following statements from no. 7 to no. 22 : On December, 2022, Company FCES arranged a meeting for reaching an investment decision. One of two mutually exclusive projects (X) and (Y) is to be nominated for acceptance. The company canarrange enough finance to establish only one of them. Project (X) : requires one establishment year followed by seven operating years. The total investment cost is L.E 10 million and net residual value of L.E 1.146 million will be expected at the end of Yr.The first five operating years of project (X) will be exempted from the 20% income tax. The expected income statement of the operating years of project (X) is as follows in L.E million: Alternative 1000 , then ignore any positive or negative NPV of less than L.E 100. 35. For project (X), At the current discount rate 17% of F the annual NCF S of the last seven years of operating" is in LE million: a. 7.582618 b. 6.83625 \begin{tabular}{l|l|l|} \hline C 8.5469508 & d. 5.86175 \\ \hline \end{tabular} a. 0.365 b. 0.880 c. (0.234) d. Zero a. (0.533) b. 0.335 c. (0.335) 19. According to the MiPV method using the current discount rate 17% of FCES Company, the "Project which should be nominated for acceptance" is: . Project (0) b. Project (V) c. Projects (X) and (Y) d. None of them together 20. The "12R of project (X)n will be: b. 18% c. 16% d. In between 16% and 17% 21. The "108 of project (M)n will be: a. 17% b. 18% c. 16% d. Less than 16% 22 . According to the IRR method, the "Project which should be nominated for acceptance" is: a. Project (D) b. Project (M) c. Projects (X) and (Y) d. None of them together Question (3)i Use the following data and information to determine the best choice for each of the following statements from no. 17 to no. 32: On December, 2022, Company FCES arranged a meeting for reaching an investment decision. One of two mutually exclusive projects (X) and (Y) is to be nominated for acceptance. The company can arrange enough finance to estabish only one of them. - Project (X) : requires one establishment year followed by seven operating years. The total investment cost is L.E 10 million and net residual value of L.E 1.146 million will be expected at paid cash when it will be incurred. - The discount rate of FCES Company is currently 17%. 17. The "Principal of Loan" which will be obtained by FCES Company before the start of Y1 to acquire project (x) will be in L.E million: a. 5.4 \begin{tabular}{l|l|l|l} & b. 5 & \multicolumn{1}{l|}{ d. 4.5} \\ 18. For project (X), by using the direct way to compute the NCF from the project's view, the "Total \\ of the Cash In-flows in Y7 will be in L.E million: \end{tabular} a. 5 b. 5.09 \begin{tabular}{ll|l|l} & b. 5.09 & c. 6.146 & d. 6.236 \\ 19. For project (X), by using the direct way to compute the NCF from the project's view, the "Total \end{tabular} of the Cash Out-flows in Y6 will be in L.E million: 3. 2.5 b. 2.35 e. 2.85 \begin{tabular}{llll} \hline & b. 2.35 & \&. 2.85 & d. 2.58 \\ \hline \end{tabular} Model (4) Page 3 of 4 21. For project (X), by using the direct way to compute the NCF from the project's view, the " NCF at the end of V7 " will be in L.E million: \begin{tabular}{l|l} 22. (10) \\ 22. For project (X), by using the direct way to compute the NCF from the project's view, the \\ "Accumuled NCF at the end of Y5" will be in L.E million: \end{tabular} "Accumulated NCF at the end of Y5" will be in L.E million: 23. For project (X), the "Pay-back Period" from the project's view after Y-1 will be: \begin{tabular}{|l|l|l|l|l|} \hline a. Two operating years & b. Three operating years & \&. Four operating years exactly & d. About 53 months of operation \end{tabular} For project (Y), the "Pay-back Period" from the project's view after Y-1 will be: and about 5 months of operation and about 3 months years 25. \begin{tabular}{|l|l|l|l|l|} \hline According to the PBP method, the "Project which should be nominated for acceptance" is: \\ \hline g. Project (X) & b. Project (Y) & c. Projects (X) and (Y) together & d. None of them \\ \hline \end{tabular} 26. For project (X), At the current discount rate 17\% of FCES Company, the "total of the PVs of the annual NCFs of the first six years of operating" is in LE million: 3. 7.582618 b. 6.83625 c. 8.5469508 d. 5.86175 27. At the current discount rate 17% of FCES Company, the "NPV of project (X)" is in LE million: a. 0.365 c. (0.234) d. 0.860 28. At the current discount rate 17% of FCES Company, the "NPV of project (Y)" is in LE million: a. (0.533) b. (0.335) c. 0.335 d. Zero 29. According to the NPV method using the current discount rate 17% of FCES Company, the "Project which should be nominated for acceptance" is: a. Project (X) b. Project (Y) c. Projects (X) and (Y) d. None of them together 30. The "IRR of project (X)" will be: a. 18% b. 17% c. 16% d. In between 16% and 17% 31. The "IRR of project (Y)" will be: a. 17% b. 18% c. 16% X \begin{tabular}{l} \begin{tabular}{|l|l|l|} \hline 1. Project (X) X & \multicolumn{1}{|c|}{ d. Less than 16%} \\ \hline \end{tabular} \\ \hline \end{tabular} 32. According to the IRR method, the "Project which should be nominated for acceptance" is: \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Years & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 \\ \hline 16% & 0.8621 & 0.7432 & 0.6407 & 0.5523 & 0.4761 & 0.4104 & 0.3538 & 0.3046 \\ \hline 17% & 0.8547 & 0.7305 & 0.6244 & 0.5337 & 0.4561 & 0.3898 & 0.3332 & 0.2848 \\ \hline 18% & 0.8475 & 0.7182 & 0.6086 & 0.5158 & 0.4371 & 0.3704 & 0.3139 & 0.2660 \\ \hline \end{tabular} You may - if it is deemed necessary - approximate only the NPV to the nearest L.E 1000 , then ignore any positive or negative NPV of less than L.E 100. Good Luck. Model (4) Page 4 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts