Question: Question 2. Use the General Journal provided to record all the necessary entries for the disposal of the asset using double entry rules: Wildfire Traders

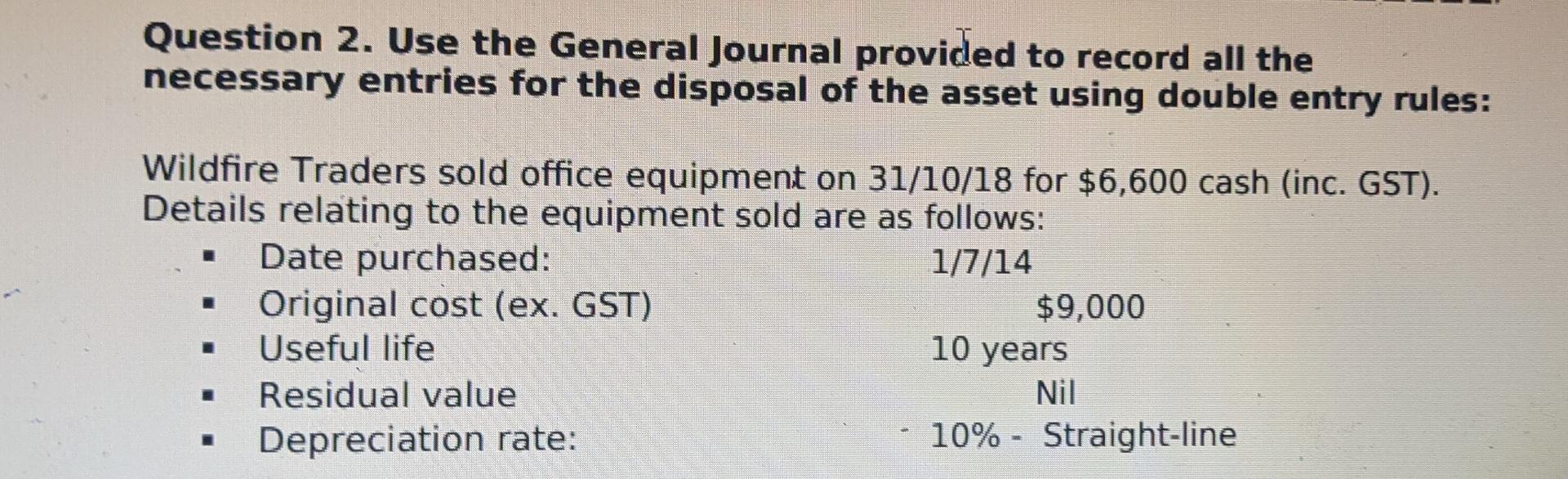

Question 2. Use the General Journal provided to record all the necessary entries for the disposal of the asset using double entry rules: Wildfire Traders sold office equipment on 31/10/18 for $6,600 cash (inc. GST). Details relating to the equipment sold are as follows: Date purchased: 1/7/14 Original cost (ex. GST) $9,000 Useful life 10 years Residual value Nil Depreciation rate: 10% - Straight-line Depreciation has been calculated and recorded in the accounting records on 30th June each year and was last recorded on 30/6/18. Required: Prepare all general journal entries necessary to record the disposal of the asset. Wildfire Traders - General Journal Date Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts