Question: QUESTION 2 Use the information given below to prepare the Cash Budget for January, February and March 2022. (Provide separate monetary columns for each month.)

QUESTION 2 Use the information given below to prepare the Cash Budget for January, February and March 2022. (Provide separate monetary columns for each month.)

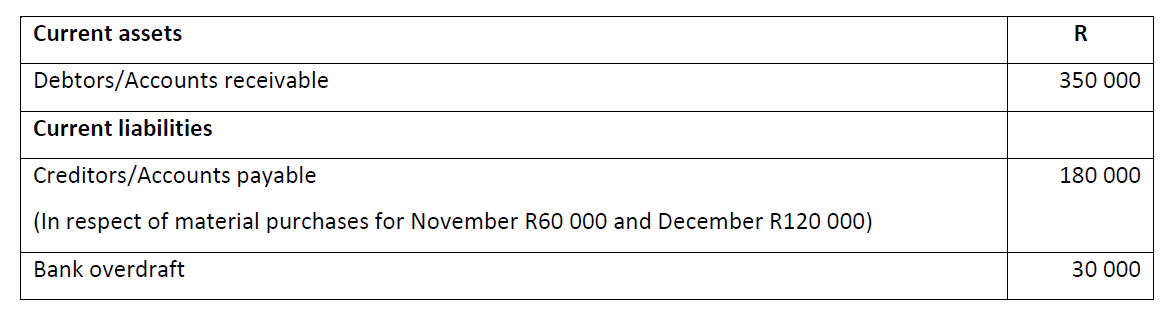

INFORMATION Some items in the projected statement of financial position as at 31 December 2021 of Fiamma Limited regarding a project are as follows:

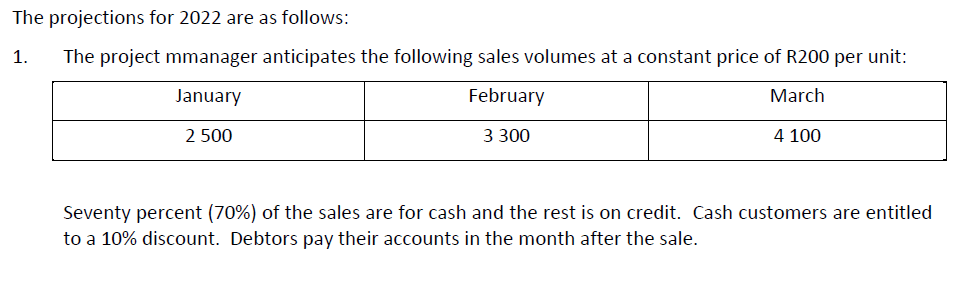

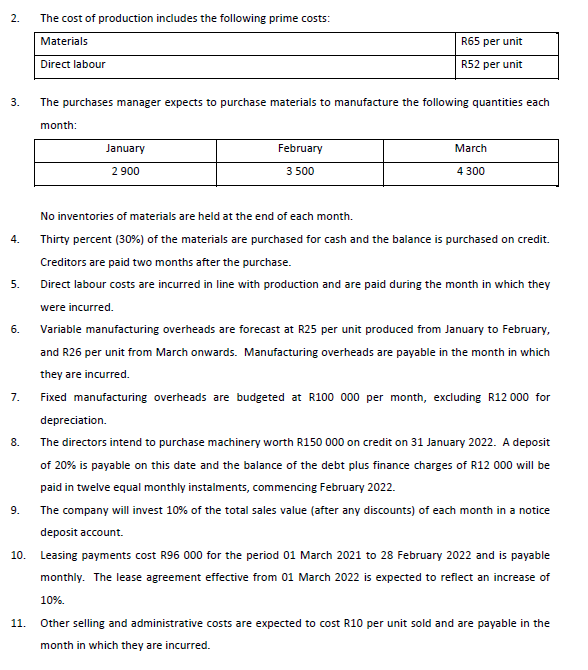

Current assets R Debtors/Accounts receivable 350 000 Current liabilities Creditors/Accounts payable 180 000 (In respect of material purchases for November R60 000 and December R120 000) Bank overdraft 30 000 The projections for 2022 are as follows: 1. The project mmanager anticipates the following sales volumes at a constant price of R200 per unit: January February March 2 500 3 300 4 100 Seventy percent (70%) of the sales are for cash and the rest is on credit. Cash customers are entitled to a 10% discount. Debtors pay their accounts in the month after the sale. 2. The cost of production includes the following prime costs: Materials Direct labour R65 per unit R52 per unit 3. The purchases manager expects to purchase materials to manufacture the following quantities each month: January March February 3 500 2 900 4 300 4. 5. 6. 7. No inventories of materials are held at the end of each month. Thirty percent (30%) of the materials are purchased for cash and the balance is purchased on credit. Creditors are paid two months after the purchase. Direct labour costs are incurred in line with production and are paid during the month in which they were incurred. Variable manufacturing overheads are forecast at R25 per unit produced from January to February, and R26 per unit from March onwards. Manufacturing overheads are payable in the month in which they are incurred. Fixed manufacturing overheads are budgeted at R100 000 per month, excluding R12 000 for depreciation. The directors intend to purchase machinery worth R150 000 on credit on 31 January 2022. A deposit of 20% is payable on this date and the balance of the debt plus finance charges of R12 000 will be paid in twelve equal monthly instalments, commencing February 2022. The company will invest 10% of the total sales value (after any discounts) of each month in a notice deposit account. 10. Leasing payments cost R96 000 for the period 01 March 2021 to 28 February 2022 and is payable monthly. The lease agreement effective from 01 March 2022 is expected to reflect an increase of 10%. 11. Other selling and administrative costs are expected to cost R10 per unit sold and are payable in the month in which they are incurred. 8. 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts