Question: Question 2 Use the information provided below to prepare the Income Statement of Aston Manufacturers for the month ended 31 March 2022 using the following

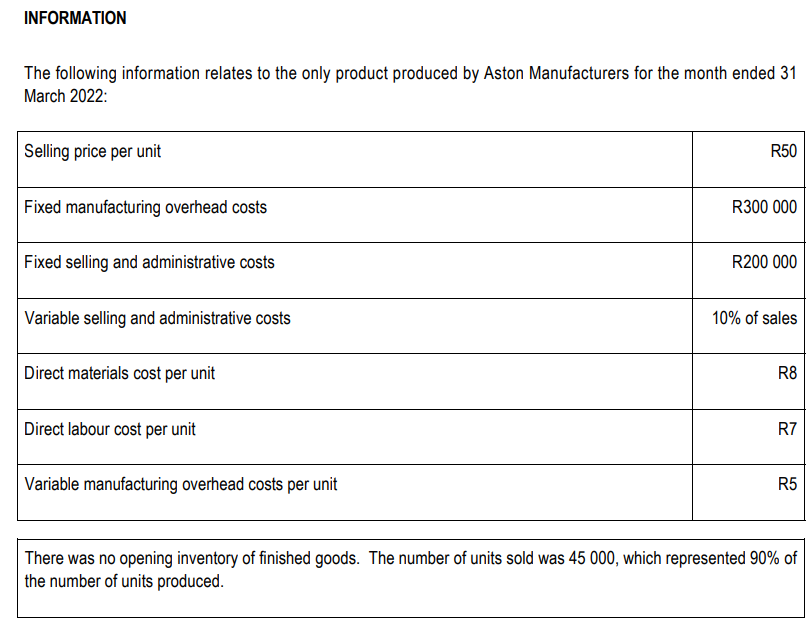

Question 2 Use the information provided below to prepare the Income Statement of Aston Manufacturers for the month ended 31 March 2022 using the following methods: 2.1 Variable costing (10 marks) 2.2 Absorption costing (10 marks) INFORMATION The following information relates to the only product produced by Aston Manufacturers for the month ended 31 March 2022: Selling price per unit R50 Fixed manufacturing overhead costs R300 000 Fixed selling and administrative costs R200 000 Variable selling and administrative costs 10% of sales Direct materials cost per unit R8 Direct labour cost per unit R7 Variable manufacturing overhead costs per unit R5 There was no opening inventory of finished goods. The number of units sold was 45 000, which represented 90% of the number of units produced.

Question 2 Use the information provided below to prepare the Income Statement of Aston Manufacturers for the month ended 31 March 2022 using the following methods: 2.1 Variable costing (10 marks) 2.2 Absorption costing (10 marks) INFORMATION The following information relates to the only product produced by Aston Manufacturers for the month ended 31 March 2022: Selling price per unit R50 Fixed manufacturing overhead costs R300 000 Fixed selling and administrative costs R200 000 Variable selling and administrative costs 10% of sales Direct materials cost per unit R8 Direct labour cost per unit R7 Variable manufacturing overhead costs per unit R5 There was no opening inventory of finished goods. The number of units sold was 45 000, which represented 90% of the number of units produced.

INFORMATION The following information relates to the only product produced by Aston Manufacturers for the month ended 31 March 2022: Selling price per unit Fixed manufacturing overhead costs Fixed selling and administrative costs Variable selling and administrative costs Direct materials cost per unit Direct labour cost per unit Variable manufacturing overhead costs per unit R50 R300 000 R200 000 10% of sales R8 R7 R5 There was no opening inventory of finished goods. The number of units sold was 45 000, which represented 90% of the number of units produced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts