Question: Question 2) Using the information from years n and n-1 below, answer the following questions. Question 2(a): What are the company's liabilities and equity in

Question 2)

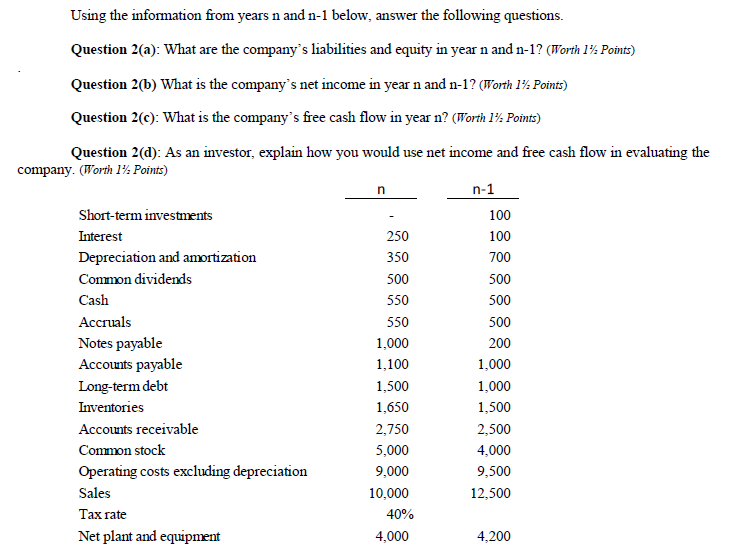

Using the information from years n and n-1 below, answer the following questions. Question 2(a): What are the company's liabilities and equity in year n and n-1? (Worth 1%% Points) Question 2(b) What is the company's net income in year n and n-1? (Worth 1%% Points) Question 2(c): What is the company's free cash flow in year n? (Worth 1%% Points) Question 2(d): As an investor, explain how you would use net income and free cash flow in evaluating the company. (Worth 1% Points) n n-1 Short-term investments 100 Interest 250 100 Depreciation and amortization 350 700 Common dividends 500 500 Cash 550 500 Accruals 550 500 Notes payable 1,000 200 Accounts payable 1,100 1,000 Long-term debt 1,500 1,000 Inventories 1,650 1,500 Accounts receivable 2,750 2,500 Common stock 5,000 4,000 Operating costs excluding depreciation 9,000 9,500 Sales 10,000 12,500 Tax rate 40% Net plant and equipment 4,000 4,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts