Question: QUESTION 2 Using the same parameters as for the stock and call option in the 2-period BOPM problem for this quiz, answer the following question:

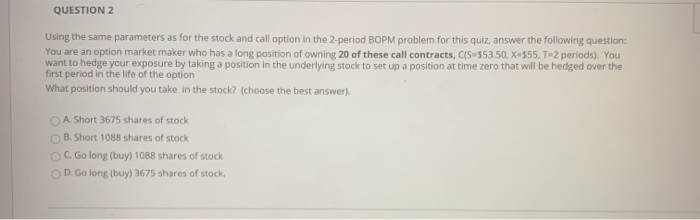

QUESTION 2 Using the same parameters as for the stock and call option in the 2-period BOPM problem for this quiz, answer the following question: You are an option market maker who has a long position of owning 20 of these call contracts, CS-553.50, X-$55, T-2 periods). You want to hedge your exposure by taking a position in the underlying stock to set up a position at time zero that will be hedged over the first period in the life of the option What position should you take in the stock? (choose the best answer) A Short 3675 shares of stock B. Short 1088 shares of stock OC. Golong (buy) 1088 shares of stock D. Golong (buy) 3675 shares of stock, QUESTION 2 Using the same parameters as for the stock and call option in the 2-period BOPM problem for this quiz, answer the following question: You are an option market maker who has a long position of owning 20 of these call contracts, CS-553.50, X-$55, T-2 periods). You want to hedge your exposure by taking a position in the underlying stock to set up a position at time zero that will be hedged over the first period in the life of the option What position should you take in the stock? (choose the best answer) A Short 3675 shares of stock B. Short 1088 shares of stock OC. Golong (buy) 1088 shares of stock D. Golong (buy) 3675 shares of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts