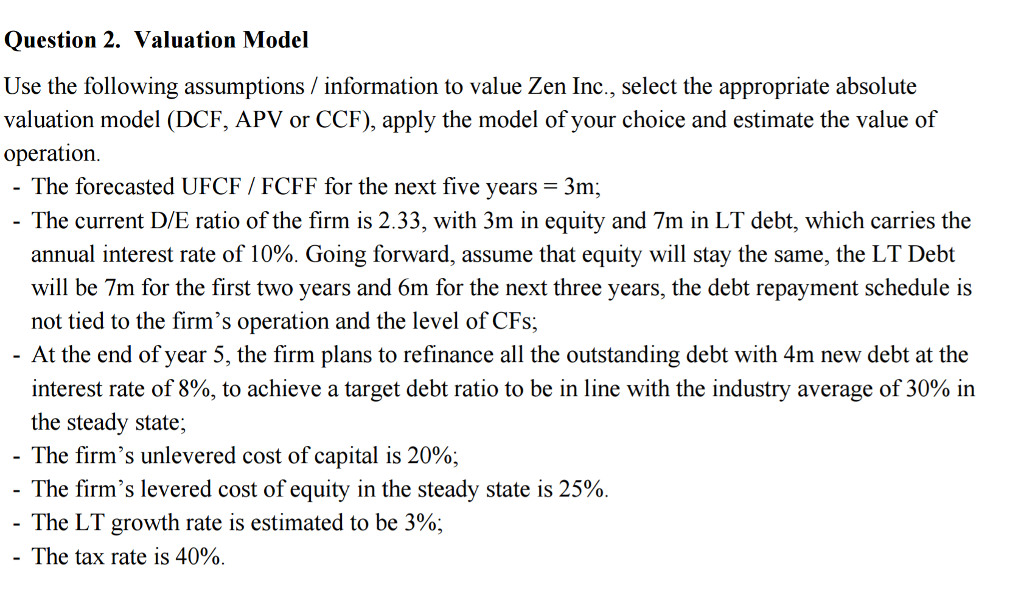

Question: Question 2. Valuation Model Use the following assumptions / information to value Zen Inc., select the appropriate absolute valuation model (DCF, APV or CCF), apply

Question 2. Valuation Model Use the following assumptions / information to value Zen Inc., select the appropriate absolute valuation model (DCF, APV or CCF), apply the model of your choice and estimate the value of operation The forecasted UFCF /FCFF for the next five years-3m; The current D/E ratio of the firm is 2.33, with 3m in equity and 7m in LT debt, which carries the annual interest rate of 10%. Going forward, assume that equity will stay the same, the LT Debt will be 7m for the first two years and 6m for the next three years, the debt repayment schedule is not tied to the firm's operation and the level of CFs; At the end of year 5, the firm plans to refinance all the outstanding debt with 4m new debt at the interest rate of 8%, to achieve a target debt ratio to be in line with the industry average of 30% in the steady state; -The firm's unlevered cost of capital is 20%; The firm's levered cost of equity in the steady state is 25%. The LT growth rate is estimated to be 3%; -The tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts