Question: Question 2 Vanda Capital allocates $15m to be managed by a boutique equity sub-fund, for which you are the portfolio manager. Suppose the risk-free rate

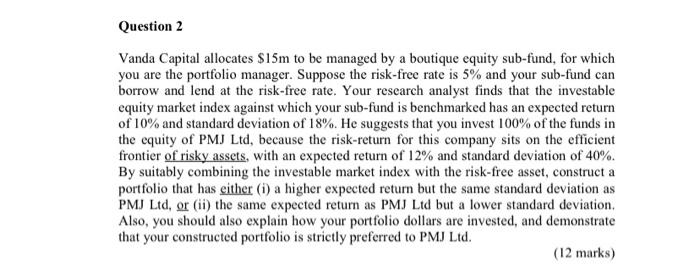

Question 2 Vanda Capital allocates $15m to be managed by a boutique equity sub-fund, for which you are the portfolio manager. Suppose the risk-free rate is 5% and your sub-fund can borrow and lend at the risk-free rate. Your research analyst finds that the investable equity market index against which your sub-fund is benchmarked has an expected return of 10% and standard deviation of 18%. He suggests that you invest 100% of the funds in the equity of PMJ Ltd, because the risk-return for this company sits on the efficient frontier of risky assets, with an expected return of 12% and standard deviation of 40%. By suitably combining the investable market index with the risk-free asset, construct a portfolio that has either (i) a higher expected return but the same standard deviation as PMJ Ltd, or (ii) the same expected return as PMJ Ltd but a lower standard deviation. Also, you should also explain how your portfolio dollars are invested, and demonstrate that your constructed portfolio is strictly preferred to PMJ Ltd. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts