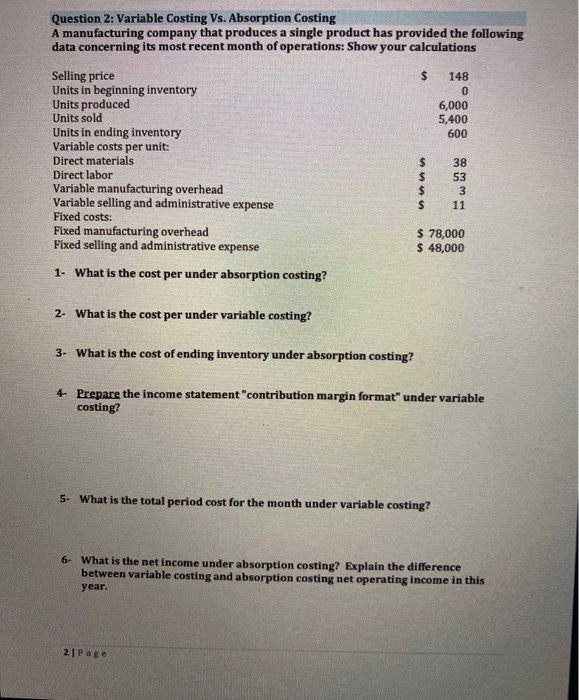

Question: Question 2: Variable Costing Vs. Absorption Costing A manufacturing company that produces a single product has provided the following data concerning its most recent month

Question 2: Variable Costing Vs. Absorption Costing A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Show your calculations $ 148 6,000 5,400 600 Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense 38 53 $ $ 78,000 $ 48,000 1. What is the cost per under absorption costing? 2- What is the cost per under variable costing? 3- What is the cost of ending inventory under absorption costing? 4. Prepare the income statement contribution margin format" under variable costing? 5. What is the total period cost for the month under variable costing? 6. What is the net income under absorption costing? Explain the difference between variable costing and absorption costing net operating income in this year. 2 | Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts