Question: Question 2 View Policies Current Attempt in Progress Logan Miller started her own accounting for Jun follow Miller Accounting on June 1, 2021. Logan Miller

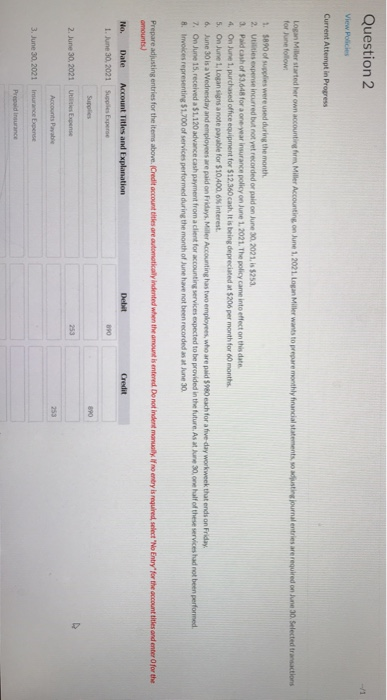

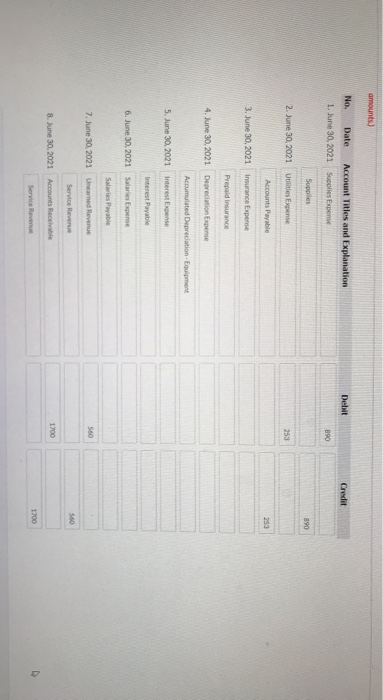

Question 2 View Policies Current Attempt in Progress Logan Miller started her own accounting for Jun follow Miller Accounting on June 1, 2021. Logan Miller wants to prepare monthly financial statements 1. $890 of supplies were used during the month. 2. Utilities expense incurred but not yet recorded or paid on June 30, 2021, is $253, 3. Pald cash of 53.648 for a one year insurance policy on June 1.2021. The policy came into effect on this date 4. On June 1. purchased office equipment for $12,360 cash. It is being depreciated at $206 per month for 6 months 5. On June 1, Logan signs a note payable for $10.400.6% interest. 6. June 30 is a Wednesday and employees we paid on Fridays, Miller Accounting has two employees, who are paid $980 each for a five-day workweek that ends on Friday, 7. On June 15, received a $1.120 advance cash payment from a client for accounting wervices expected to be provided in the future. As a re nehalf of these services had not been performed 8. Invoices representing 51.700 of services performed during the month of June have not been recorded as at June 30 Prepare adjusting entries for the items above. Credit accounties are automatically indented when the amount is entered Do not indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts No. Date Account Titles and Explanation 1. June 30, 2021 Supplies Experte 2. June 30, 2021 Uits Expense 3. June 30, 2021 Insurance Expense amounts) No. Date Account Titles and Explanation Credit 1. June 30, 2021 Supplies Expense 2. June 30, 2021 Utilities Expense Accounts Payable 3. June 30, 2021 Insurance Expense Prepaid Insurance 4. June 30, 2021 Depreciation Expense Accumulated Depreciation Equipment 5. June 30, 2021 Interest Expense Interest Payable 6. June 30, 2021 Series Expense Sales Payable 7. June 30, 2021 Unearned Revenue Service Revenue 8. June 30, 2021 Accounts Receivable Service Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts