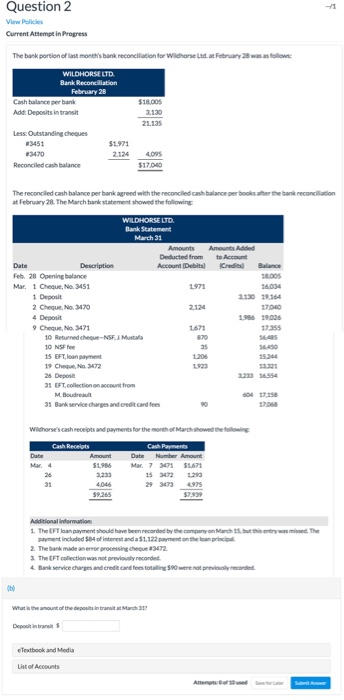

Question: Question 2 View Policies Current Attempt in Progress The bank portion of last month's bank reconciliation for Wadorsed February 28 w as follows WILDHORSE LTD

Question 2 View Policies Current Attempt in Progress The bank portion of last month's bank reconciliation for Wadorsed February 28 w as follows WILDHORSE LTD Bank Reconciliation February 28 Cash balance per bank Add: Deposits in transit $18.005 3.130 Less: Outstanding cheques 13451 $1971 2124 Reconciled cash balance The reconciled cash balance per bank agreed with the reconciled cash balance per booster the bank reconciliation at February 28. The March bank statement showed the following WILDHORSE LTD. Ilank Statement 2.13 Amounts Amount. Added Deducted from to Account Date Description Account Debatt Feb 28 Opening balance Mar. 1 Chegue, No3451 16.034 1 Deposit 2 Chegue, No 1470 4 Deposit 1986 19.026 9 Chou. No 171 1.671 17355 10 Returned cheque-NSF. Mustafa SOS 10 NSF 35 14450 15 EFT payment 1.200 15.24 19 Cheque N 272 1923 26 Deposit 33 EFT collection on account from M. Boud 604 17.58 31 Bank service changes and credit card fees 17000 Withorse's cash receipts and payments for the month of March showed the following Cash Recelets Amount 51.986 1.233 4,046 59.265 Date Number Amount Mar 7 347151671 15 3472 1293 29 34734925 52939 Additional information 1. The loan payment should have been recorded by the company on Marchbuttorasid. The payment included 584 of interest and a $1.122 payment on the loan principal 2 The bank made an eror processing chegue 3472 The EFT collection was not previously recorded 4. Bank service charges and credit cards t o previously recorded What is the amount of the i r March Deports Textbook and Media List of Accounts Anemos Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts