Question: Question 2. What is the present value of a security that will pay $20,000 in 10 years if securities of equal risk pay 4% annually?

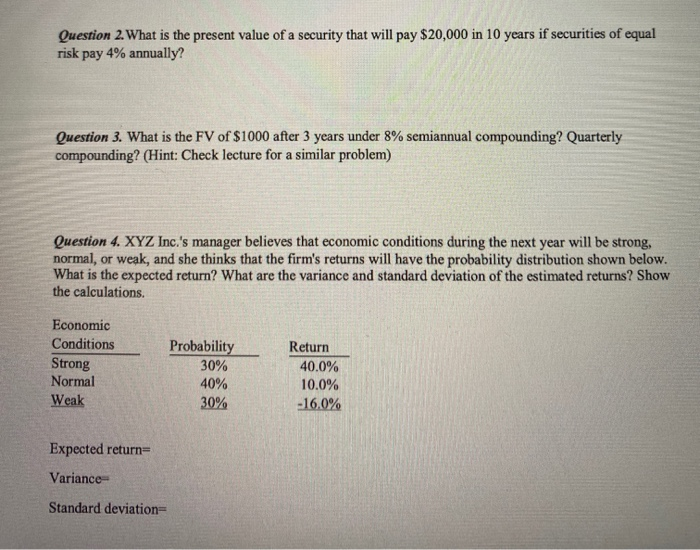

Question 2. What is the present value of a security that will pay $20,000 in 10 years if securities of equal risk pay 4% annually? Question 3. What is the FV of $1000 after 3 years under 8% semiannual compounding? Quarterly compounding? (Hint: Check lecture for a similar problem) Question 4. XYZ Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What is the expected return? What are the variance and standard deviation of the estimated returns? Show the calculations. Economic Conditions Strong Normal Weak Probability 30% 40% 30% Return 40.0% 10.0% -16.0% Expected return Variance- Standard deviations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts