Question: QUESTION 2 What is the required return for the FIN340 Company if it has a Beta of 0.5, the Market Return is 10.0%, and the

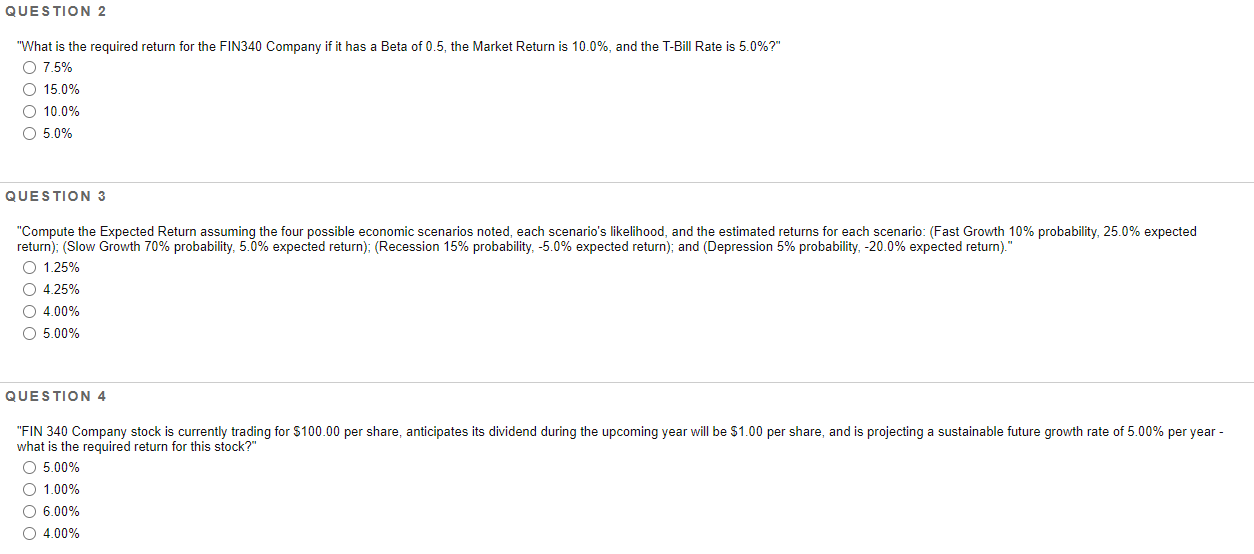

QUESTION 2 "What is the required return for the FIN340 Company if it has a Beta of 0.5, the Market Return is 10.0%, and the T-Bill Rate is 5.0%?" O 7.5% O 15.0% O 10.0% O 5.0% QUESTION 3 "Compute the Expected Return assuming the four possible economic scenarios noted, each scenario's likelihood, and the estimated returns for each scenario: (Fast Growth 10% probability, 25.0% expected return): (Slow Growth 70% probability, 5.0% expected return): (Recession 15% probability, -5.0% expected return); and (Depression 5% probability, -20.0% expected return)." O 1.25% O 4.25% O 4.00% O 5.00% QUESTION 4 "FIN 340 Company stock is currently trading for $100.00 per share, anticipates its dividend during the upcoming year will be $1.00 per share, and is projecting a sustainable future growth rate of 5.00% per year - what is the required return for this stock?" O 5.00% O 1.00% O 6.00% 0 4.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts