Question: QUESTION 2 When valuing a company using Discounted Cash Flow Analysis, systematic risk should be reflected in: The risk-free rate The cost of debt The

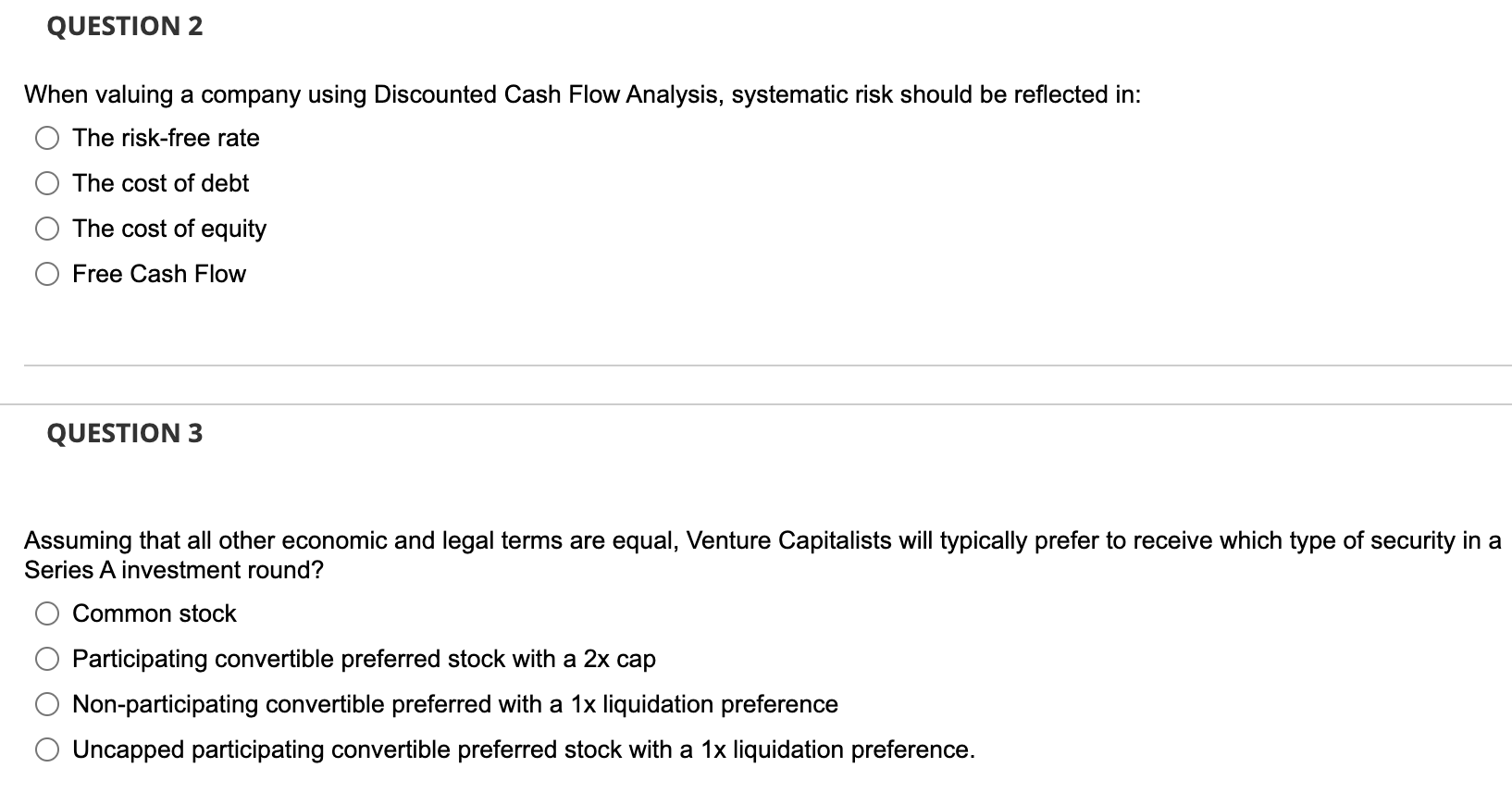

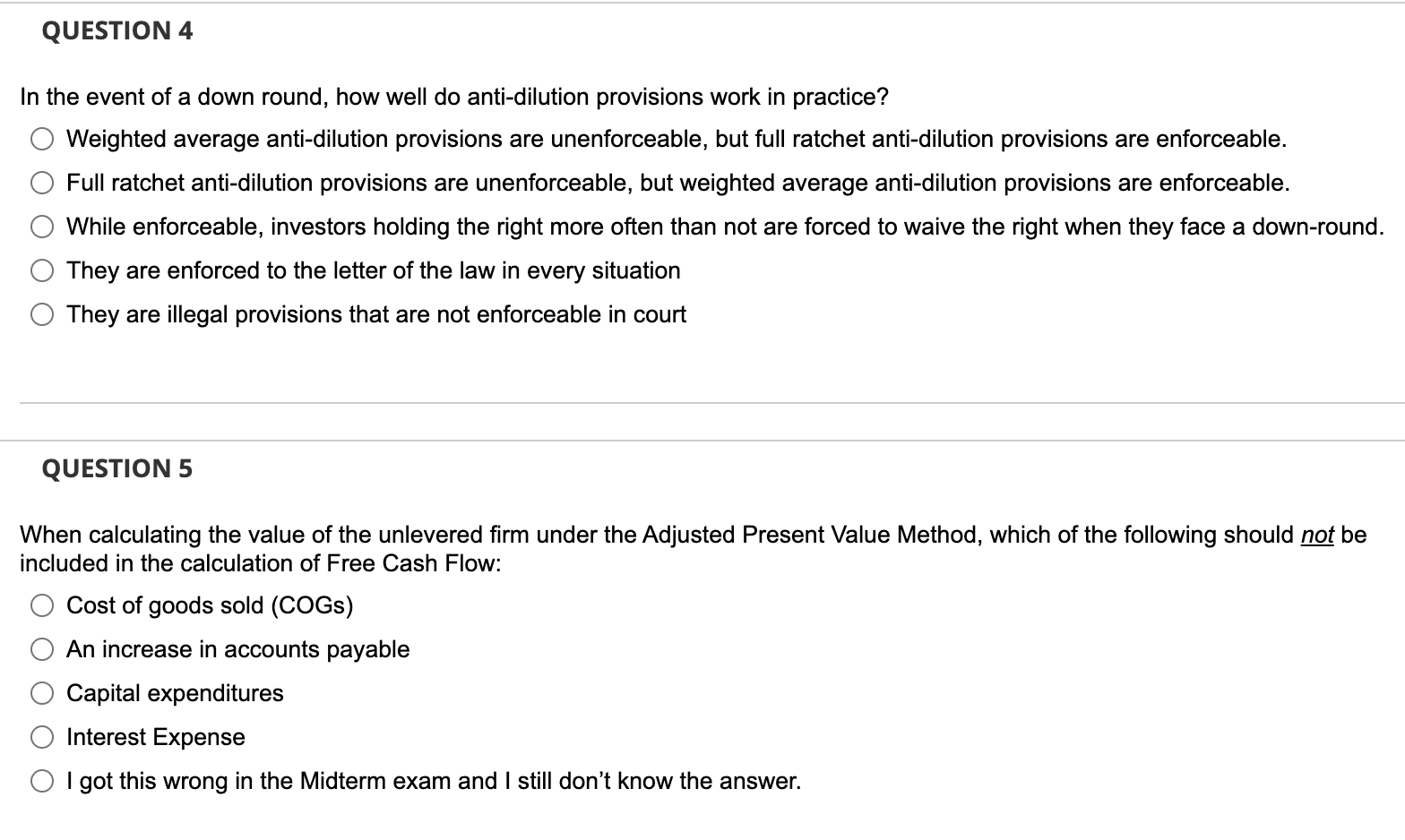

QUESTION 2 When valuing a company using Discounted Cash Flow Analysis, systematic risk should be reflected in: The risk-free rate The cost of debt The cost of equity Free Cash Flow QUESTION 3 Assuming that all other economic and legal terms are equal, Venture Capitalists will typically prefer to receive which type of security in a Series A investment round? Common stock Participating convertible preferred stock with a 2x cap Non-participating convertible preferred with a 1x liquidation preference Uncapped participating convertible preferred stock with a 1x liquidation preference. QUESTION 4 In the event of a down round, how well do anti-dilution provisions work in practice? Weighted average anti-dilution provisions are unenforceable, but full ratchet anti-dilution provisions are enforceable. Full ratchet anti-dilution provisions are unenforceable, but weighted average anti-dilution provisions are enforceable. While enforceable, investors holding the right more often than not are forced to waive the right when they face a down-round. They are enforced to the letter of the law in every situation They are illegal provisions that are not enforceable in court QUESTION 5 When calculating the value of the unlevered firm under the Adjusted Present Value Method, which of the following should not be included in the calculation of Free Cash Flow: Cost of goods sold (COGs) An increase in accounts payable Capital expenditures Interest Expense O I got this wrong in the Midterm exam and I still don't know the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts