Question: Question 2 with solutions Shift 0 Ctrt Managerial Finance FIN 350 ENTERTAINMENT,INC Chapter Ten Mini Case Study Points: 5 Name: The Computer Games Division of

Question 2 with solutions

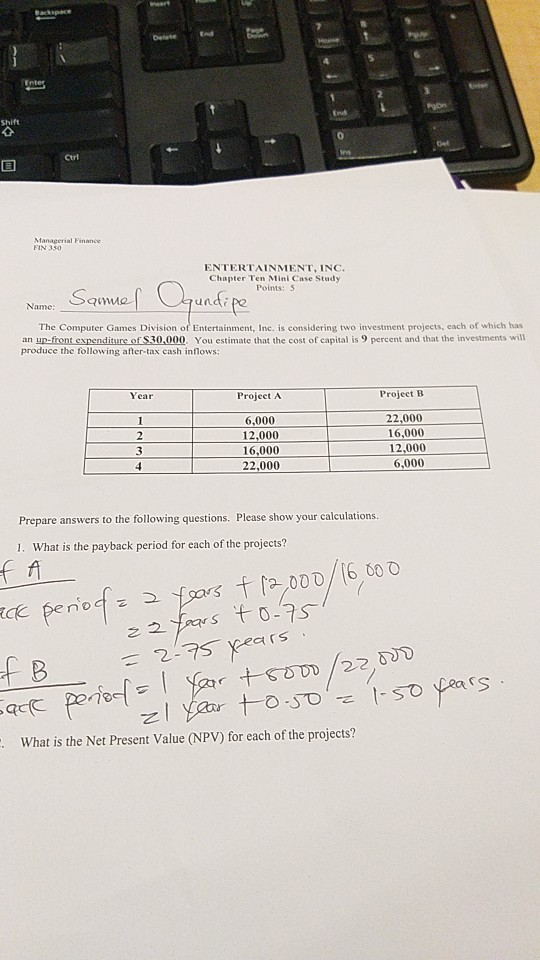

Shift 0 Ctrt Managerial Finance FIN 350 ENTERTAINMENT,INC Chapter Ten Mini Case Study Points: 5 Name: The Computer Games Division of Entertainment, Inc, is considering two investment projects, each of which has an un-front expenditure of $30,000. You estimate that the cost of capital is 9 percent and that the investments will produce the following after-tax cash inflows Project A car Project B 6,000 12,000 16,000 22,000 16.000 12,000 6,000 Prepare answers to the following questions. Please show your calculations. 1. What is the payback period for each of the projects? period z = 2.75e ears What is the Net Present Value (NPV) for each of the projects? Deletend age Shift Ctri Ins Del 3. If the two projects are indsnendent and the cost of capital is 9 percent, which project or projects should Entertainment, Inc undertake? If the two projects are mutually exclusive and the cost of capital is 9 percent, which project should Entertainment, Inc. undertake? (Hint: With mutually exclusive projects -a situation in which only one of the two projects could be done, but not both - the NPV method provides the theoretically best answer 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts