Question: Question 2 XYZ is evaluating a project that would require the purchase of a plec and relevant depreciation of $132,000. XYZ would need to borrow

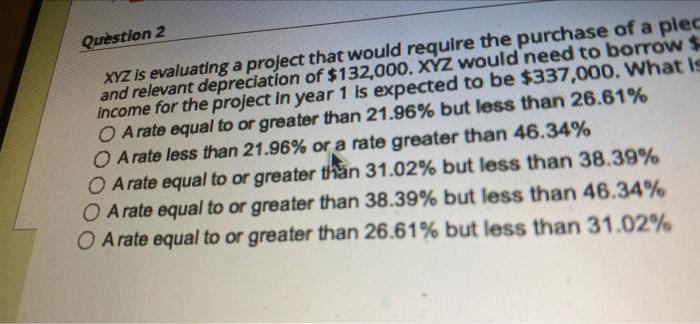

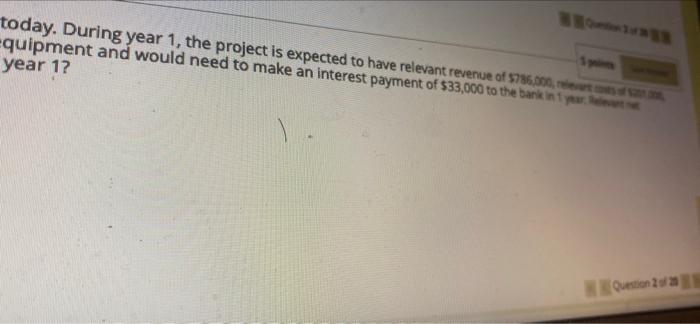

Question 2 XYZ is evaluating a project that would require the purchase of a plec and relevant depreciation of $132,000. XYZ would need to borrow $ income for the project in year 1 is expected to be $337,000. What is O A rate equal to or greater than 21.96% but less than 26.61% O A rate less than 21.96% or a rate greater than 46.34% O A rate equal to or greater than 31.02% but less than 38.39% O A rate equal to or greater than 38.39% but less than 46.34% O A rate equal to or greater than 26.61% but less than 31.02% 1 points today. During year 1, the project is expected to have relevant revenue of $786,000, relevant costs of 200 equipment and would need to make an interest payment of $33,000 to the bank year 1? Question 2 of 20 Question 2 XYZ is evaluating a project that would require the purchase of a plec and relevant depreciation of $132,000. XYZ would need to borrow $ income for the project in year 1 is expected to be $337,000. What is O A rate equal to or greater than 21.96% but less than 26.61% O A rate less than 21.96% or a rate greater than 46.34% O A rate equal to or greater than 31.02% but less than 38.39% O A rate equal to or greater than 38.39% but less than 46.34% O A rate equal to or greater than 26.61% but less than 31.02% 1 points today. During year 1, the project is expected to have relevant revenue of $786,000, relevant costs of 200 equipment and would need to make an interest payment of $33,000 to the bank year 1? Question 2 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts