Question: Question 2: XYZ Mining has just announced it will cut its dividend from $4.00 to $2.50 per share and use the extra funds to expand.

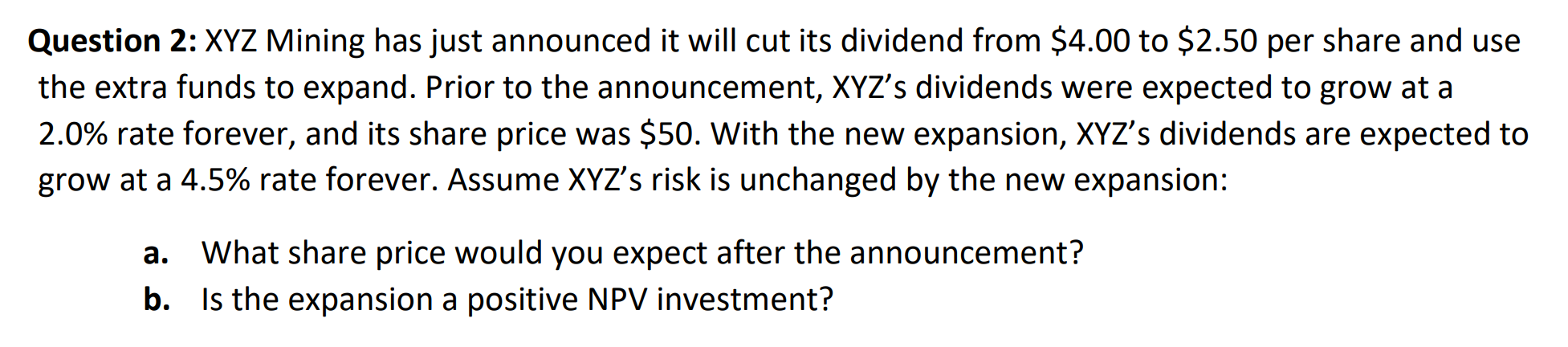

Question 2: XYZ Mining has just announced it will cut its dividend from $4.00 to $2.50 per share and use the extra funds to expand. Prior to the announcement, XYZ's dividends were expected to grow at a 2.0% rate forever, and its share price was $50. With the new expansion, XYZ's dividends are expected to grow at a 4.5% rate forever. Assume XYZ's risk is unchanged by the new expansion: a. What share price would you expect after the announcement? b. Is the expansion a positive NPV investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts