Question: QUESTION 2 You are a consultant with Alpha Ltd and have been engaged by Blue Plc to evaluate financing options for its acquisition of Green

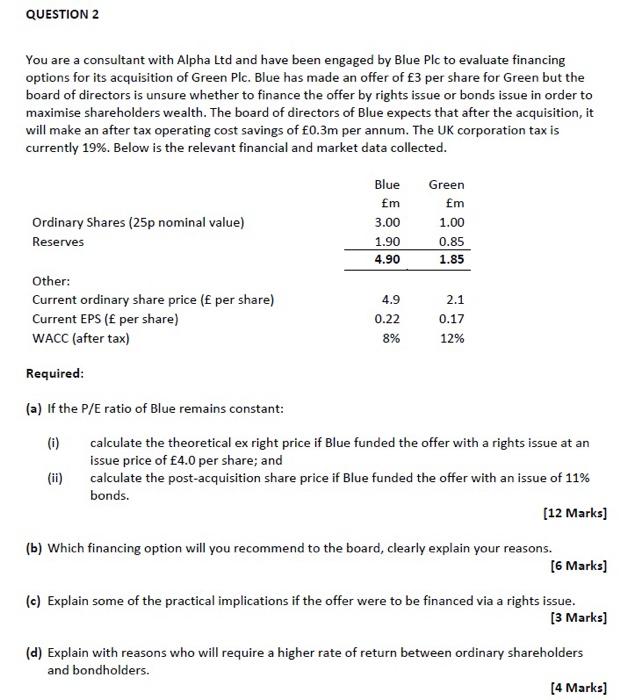

QUESTION 2 You are a consultant with Alpha Ltd and have been engaged by Blue Plc to evaluate financing options for its acquisition of Green Plc. Blue has made an offer of 3 per share for Green but the board of directors is unsure whether to finance the offer by rights issue or bonds issue in order to maximise shareholders wealth. The board of directors of Blue expects that after the acquisition, it will make an after tax operating cost savings of 0.3m per annum. The UK corporation tax is currently 19%. Below is the relevant financial and market data collected. Ordinary Shares (25p nominal value) Reserves Blue Em 3.00 1.90 4.90 Green Em 1.00 0.85 1.85 Other: Current ordinary share price ( per share) Current EPS ( per share) WACC (after tax) 4.9 0.22 8% 2.1 0.17 12% Required: (a) If the P/E ratio of Blue remains constant: (i) calculate the theoretical ex right price if Blue funded the offer with a rights issue at an issue price of 4.0 per share; and calculate the post-acquisition share price if Blue funded the offer with an issue of 11% bonds. [12 Marks] (b) Which financing option will you recommend to the board, clearly explain your reasons. (6 Marks] (c) Explain some of the practical implications if the offer were to be financed via a rights issue. [3 Marks) (d) Explain with reasons who will require a higher rate of return between ordinary shareholders and bondholders. (4 Marks] QUESTION 2 You are a consultant with Alpha Ltd and have been engaged by Blue Plc to evaluate financing options for its acquisition of Green Plc. Blue has made an offer of 3 per share for Green but the board of directors is unsure whether to finance the offer by rights issue or bonds issue in order to maximise shareholders wealth. The board of directors of Blue expects that after the acquisition, it will make an after tax operating cost savings of 0.3m per annum. The UK corporation tax is currently 19%. Below is the relevant financial and market data collected. Ordinary Shares (25p nominal value) Reserves Blue Em 3.00 1.90 4.90 Green Em 1.00 0.85 1.85 Other: Current ordinary share price ( per share) Current EPS ( per share) WACC (after tax) 4.9 0.22 8% 2.1 0.17 12% Required: (a) If the P/E ratio of Blue remains constant: (i) calculate the theoretical ex right price if Blue funded the offer with a rights issue at an issue price of 4.0 per share; and calculate the post-acquisition share price if Blue funded the offer with an issue of 11% bonds. [12 Marks] (b) Which financing option will you recommend to the board, clearly explain your reasons. (6 Marks] (c) Explain some of the practical implications if the offer were to be financed via a rights issue. [3 Marks) (d) Explain with reasons who will require a higher rate of return between ordinary shareholders and bondholders. (4 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts