Question: Question 2: You are advising a sugar trader on the hedging of the stocks of sugar the trader holds currently to sell after two

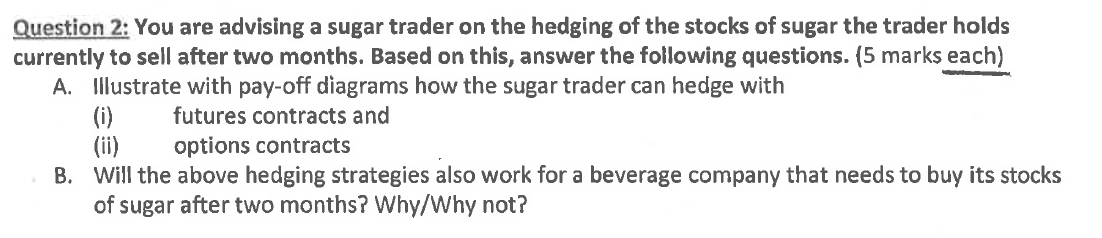

Question 2: You are advising a sugar trader on the hedging of the stocks of sugar the trader holds currently to sell after two months. Based on this, answer the following questions. (5 marks each) A. Illustrate with pay-off diagrams how the sugar trader can hedge with (i) (ii) futures contracts and options contracts B. Will the above hedging strategies also work for a beverage company that needs to buy its stocks of sugar after two months? Why/Why not?

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Hedging with Futures Contracts 1 Scenario 1 Sugar Prices Increase If the price of sugar rises the sugar trader will incur losses on the physical sugar ... View full answer

Get step-by-step solutions from verified subject matter experts