Question: Question 2 You are contemplating which stocks to purchase, between Lagenda Properties Berhad and Sime Darby Property Berhad listed on the Main Market of Bursa

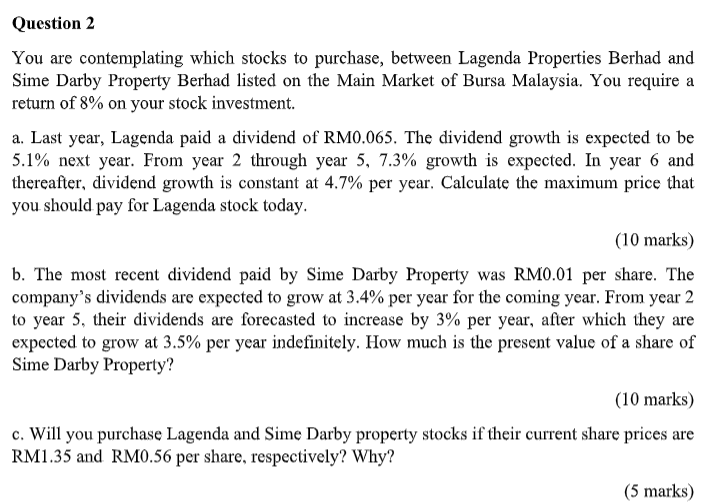

Question 2 You are contemplating which stocks to purchase, between Lagenda Properties Berhad and Sime Darby Property Berhad listed on the Main Market of Bursa Malaysia. You require a return of 8% on your stock investment. a. Last year, Lagenda paid a dividend of RM0.065. The dividend growth is expected to be 5.1% next year. From year 2 through year 5, 7.3% growth is expected. In year 6 and thereafter, dividend growth is constant at 4.7% per year. Calculate the maximum price that you should pay for Lagenda stock today. (10 marks) b. The most recent dividend paid by Sime Darby Property was RM0.01 per share. The company's dividends are expected to grow at 3.4% per year for the coming year. From year 2 to year 5, their dividends are forecasted to increase by 3% per year, after which they are expected to grow at 3.5% per year indefinitely. How much is the present value of a share of Sime Darby Property? (10 marks) c. Will you purchase Lagenda and Sime Darby property stocks if their current share prices are RM1.35 and RM0.56 per share, respectively? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts