Question: Question 2 You are provided with the following information. . Year 0 sales per share: 35 Initial sales growth for three years: 15% Sales growth

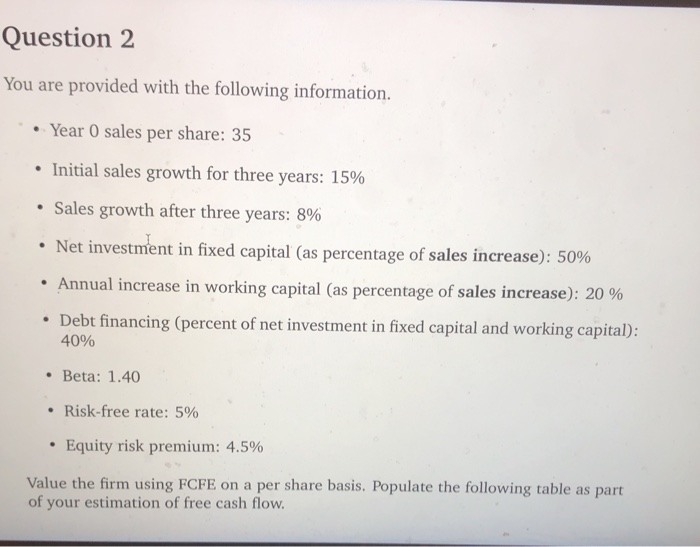

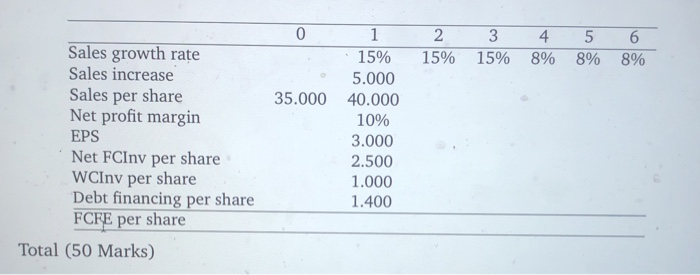

Question 2 You are provided with the following information. . Year 0 sales per share: 35 Initial sales growth for three years: 15% Sales growth after three years: 8% Net investment in fixed capital (as percentage of sales increase): 50% Annual increase in working capital (as percentage of sales increase): 20 % Debt financing (percent of net investment in fixed capital and working capital): 40% Beta: 1.40 Risk-free rate: 5% Equity risk premium: 4.5% Value the firm using FCFE on a per share basis. Populate the following table as part of your estimation of free cash flow. 0 2 15% 3 15% 4 8% 5 8% 6 8% 35.000 Sales growth rate Sales increase Sales per share Net profit margin EPS Net FCInv per share WCInv per share Debt financing per share FCFE per share 1 15% 5.000 40.000 10% 3.000 2.500 1.000 1.400 Total (50 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts