Question: Question 2 You sell shredding services. When you perform them in your state, they are not taxable, but you also have an office in a

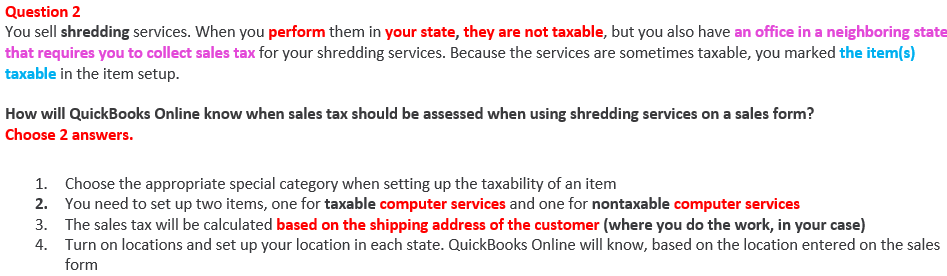

Question 2 You sell shredding services. When you perform them in your state, they are not taxable, but you also have an office in a neighboring state that requires you to collect sales tax for your shredding services. Because the services are sometimes taxable, you marked the item(s) taxable in the item setup. How will QuickBooks Online know when sales tax should be assessed when using shredding services on a sales form? Choose 2 answers. 1. Choose the appropriate special category when setting up the taxability of an item 2. You need to set up two items, one for taxable computer services and one for nontaxable computer services 3. The sales tax will be calculated based on the shipping address of the customer (where you do the work, in your case) 4. Turn on locations and set up your location in each state. QuickBooks Online will know, based on the location entered on the sales form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts