Question: QUESTION 2 Your client wants to be that a certain stock (which pays no dividends) will exhibit very little movement within the next one year.

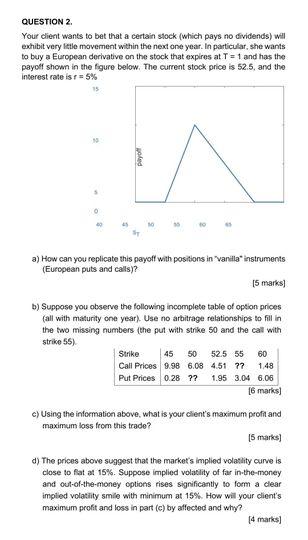

QUESTION 2 Your client wants to be that a certain stock (which pays no dividends) will exhibit very little movement within the next one year. In particular, she wants to buy a European derivative on the stock that expires at T = 1 and has the payoff shown in the figure below. The current stock price is 52.5, and the Interest rate is r5% w a a) How can you replicate this payoff with positions in "vanilla- instruments (European puts and calls)? [5 marks] b) Suppose you observe the following incomplete table of option prices (all with maturity one year). Use no arbitrage relationships to fill in the two missing numbers (the put with strike 50 and the call with Strike 55) Strike 45 50 52.5 55 60 Call Prices 9.98 6.08 4.51 ?? Put Prices 0.28 ?? 1.95 3.04 6.05 [6 marks) 1.48 c) Using the information above, what is your client's maximum profit and maximum loss from this trade? 15 marks) d) The prices above suggest that the market's implied volatility curve is close to flat at 15%. Suppose implied volatility of far in-the-money and out-of-the-money options rises significantly to form a clear implied volatility smile with minimum at 15%. How will your client's maximum profit and loss in part (c) by affected and why? [4 marks) QUESTION 2 Your client wants to be that a certain stock (which pays no dividends) will exhibit very little movement within the next one year. In particular, she wants to buy a European derivative on the stock that expires at T = 1 and has the payoff shown in the figure below. The current stock price is 52.5, and the Interest rate is r5% w a a) How can you replicate this payoff with positions in "vanilla- instruments (European puts and calls)? [5 marks] b) Suppose you observe the following incomplete table of option prices (all with maturity one year). Use no arbitrage relationships to fill in the two missing numbers (the put with strike 50 and the call with Strike 55) Strike 45 50 52.5 55 60 Call Prices 9.98 6.08 4.51 ?? Put Prices 0.28 ?? 1.95 3.04 6.05 [6 marks) 1.48 c) Using the information above, what is your client's maximum profit and maximum loss from this trade? 15 marks) d) The prices above suggest that the market's implied volatility curve is close to flat at 15%. Suppose implied volatility of far in-the-money and out-of-the-money options rises significantly to form a clear implied volatility smile with minimum at 15%. How will your client's maximum profit and loss in part (c) by affected and why? [4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts