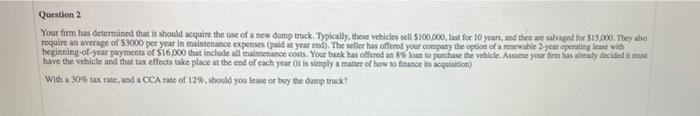

Question: Question 2 Your firm has determined that it should acquire the use of a new dump truck Typically, these vehicles sell 5100.000, last for 10

Question 2 Your firm has determined that it should acquire the use of a new dump truck Typically, these vehicles sell 5100.000, last for 10 years, and then are salvaged for $15.000. They abo require an average of 53000 per year in maintenance expenses (paid at year ends. The seller has offered your company the option of wale year operating lease with beginning of year payments of $16700 that include all maintenance costs. Your bank has offered an 8 loan to purchase the vehicle. Assume your firm has already decided it must have the vehicle and that tax effects take place at the end of each year it is simply a matter of how to finance its acquisition) With a 30% tax rate, and CCA rate of 129, should you leate or by the dump track

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts