Question: Question 20 0/ 1 pts Which project would be preferable if both projects were of average risk as the overall firm and Tangshan Mining has

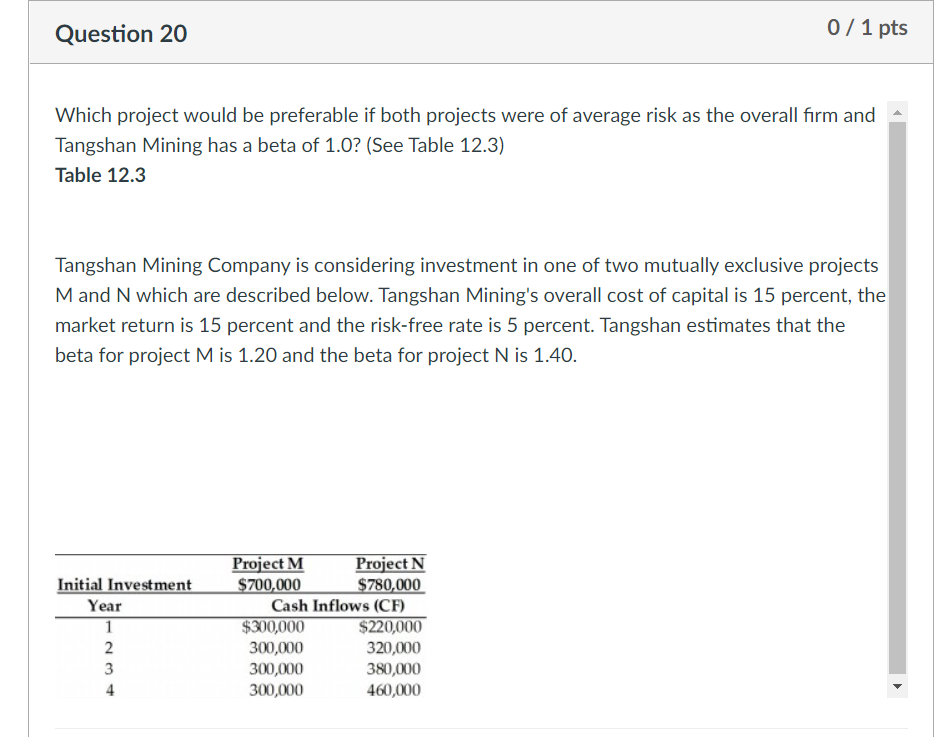

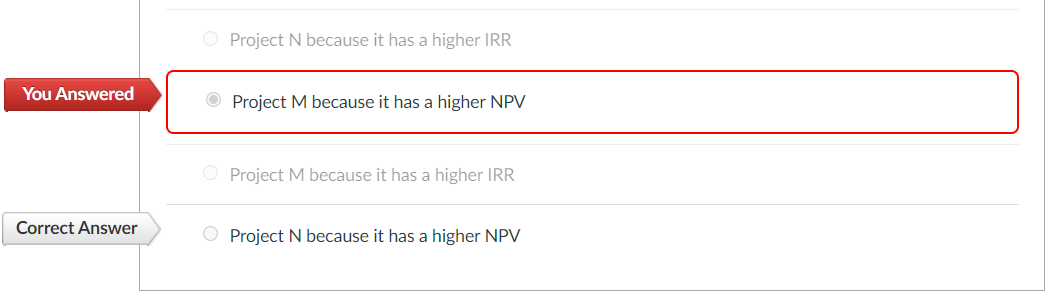

Question 20 0/ 1 pts Which project would be preferable if both projects were of average risk as the overall firm and Tangshan Mining has a beta of 1.0? (See Table 12.3) Table 12.3 Tangshan Mining Company is considering investment in one of two mutually exclusive projects Mand N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project Nis 1.40. Initial Investment Year 1 2. 3 4 Project M Project N $700,000 $780,000 Cash Inflows (CF) $300,000 $220,000 300,000 320,000 300,000 380,000 300,000 460,000 O Project N because it has a higher IRR You Answered Project M because it has a higher NPV Project M because it has a higher IRR Correct Answer O Project N because it has a higher NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts