Question: Question 20 (1 point) Consider a project with the following information: initial fixed asset investment = $400.000; straight-line depreciation to zero over the five-year life;

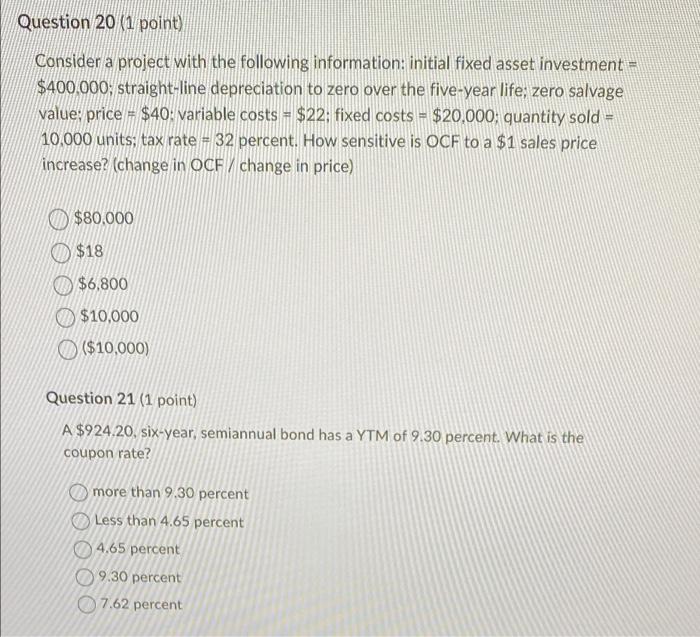

Question 20 (1 point) Consider a project with the following information: initial fixed asset investment = $400.000; straight-line depreciation to zero over the five-year life; zero salvage value: price = $40: variable costs = $22: fixed costs = $20,000; quantity sold = 10.000 units; tax rate = 32 percent. How sensitive is OCF to a $1 sales price increase? (change in OCF/ change in price) - $80,000 $18 $6,800 $10,000 ($10,000) Question 21 (1 point) A $924.20, six-year, semiannual bond has a YTM of 9.30 percent. What is the coupon rate? more than 9.30 percent Less than 4.65 percent 4.65 percent 9.30 percent 7.62 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock