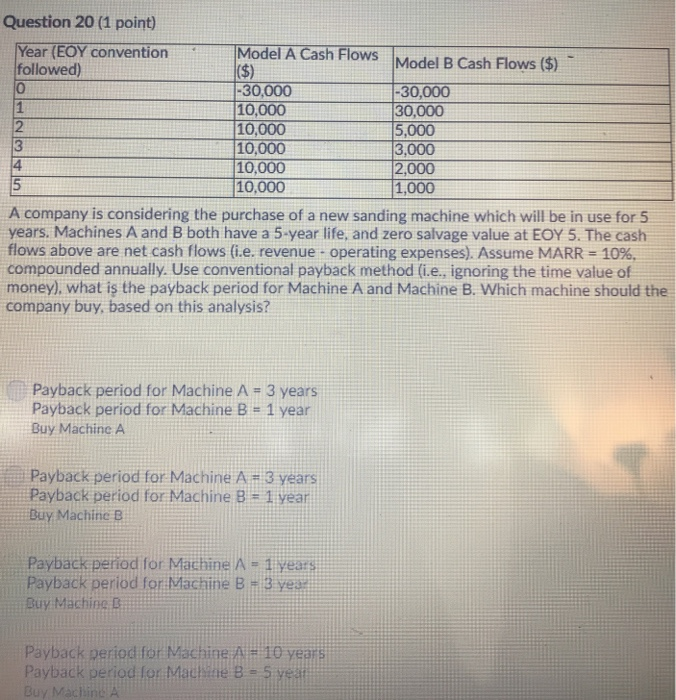

Question: Question 20 (1 point) Model A Cash Flows Model B Cash Flows ($) Year (EOY convention followed) 0 30,000 10,000 10,000 10,000 10,000 10,000 -30,000

Question 20 (1 point) Model A Cash Flows Model B Cash Flows ($) Year (EOY convention followed) 0 30,000 10,000 10,000 10,000 10,000 10,000 -30,000 30,000 5,000 3,000 2,000 1,000 2 4 A company is considering the purchase of a new sanding machine which will be in use for 5 years. Machines A and B both have a 5-year life, and zero salvage value at EOY 5. The cash flows above are net cash flows (ie, revenue-operating expenses). Assume MARR-10%. compounded annually. Use conventional payback method (i.e., ignoring the time value of money), what is the payback period for Machine A and Machine B. Which machine should the company buy, based on this analysis? Payback period for Machine A 3 years Payback period for Machine B 1 year Buy Machine A Payback period for Machine A # 3 years Payback period for Machine 8- 1 year Buy MachinetB Payback period for Machine A - 1 years Payback period for Machine B 3 year :Buy Machine B Payback period for Machine A- 10 year Payback period lor Mactsine B 5 vea

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts