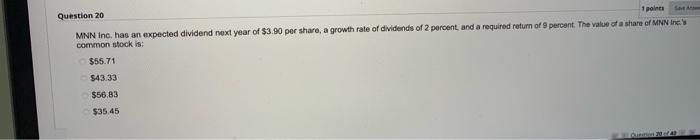

Question: Question 20 1 points MNN Inc. has an expected dividend next year of $3.90 per share, a growth rate of dividends of 2 percent, and

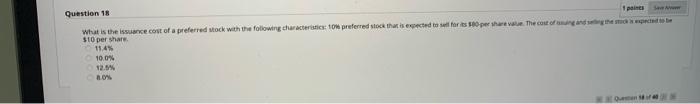

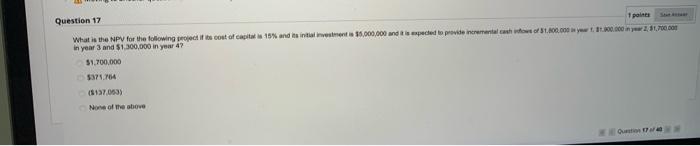

Question 20 1 points MNN Inc. has an expected dividend next year of $3.90 per share, a growth rate of dividends of 2 percent, and a required return of 9 percent. The value of a share of MNNIS common stock is: $55.71 $43.33 $56.83 $35.45 www Question 18 What is the issuance cost of a preferred Mock with the following characteristics 10 preferred to the sected to sell for speshare the cost of the $10 per share 11.45 10.0% 12.9% 10% Question 17 points What is the NPV for the following project is cost of capita 15% and its investment 16,000,000 and expected to provide incremental cach w of 31.100.000 yw ... 2. 11.00 in year and $1,300,000 in your 4? $1,700,000 3371.164 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts