Question: Question 20 1 points This question will not appear in the Final Exam as it is time consuming. Repeat all the steps in the video

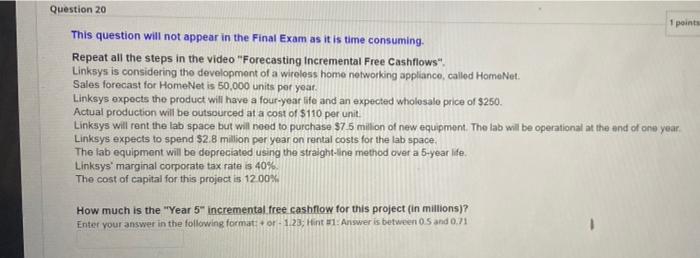

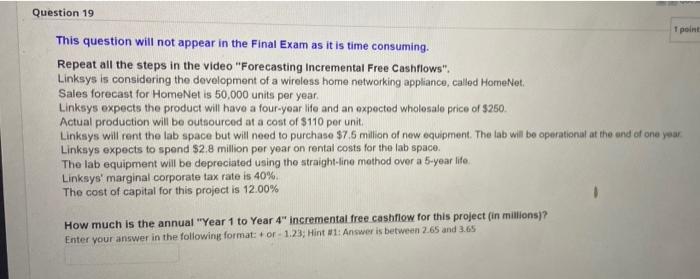

Question 20 1 points This question will not appear in the Final Exam as it is time consuming. Repeat all the steps in the video "Forecasting Incremental Free Cashflows". Linksys is considering the development of a wireless home networking applianco, called HomeNet. Sales forecast for HomeNet is 50,000 units per year. Linksys expects the product will have a four-year life and an expected wholesale price of $250. Actual production will be outsourced at a cost of $110 per unit Linksys will rent the lab space but will need to purchase $7.5 milion of new equipment. The lab will be operational at the end of one year Linksys expects to spend $2.8 million per year on rental costs for the lab space, The lab equipment will be depreciated using the straight-line method over a 5-year life. Linksys' marginal corporate tax rate is 40% The cost of capital for this project is 12.00% How much is the "Year 5" incremental free cashflow for this project (in millions)? Enter your answer in the following formator -1.28; Hinton Answer is between 0.5 and 0.71 Question 19 1 point This question will not appear in the Final Exam as it is time consuming. Repeat all the steps in the video "Forecasting Incremental Free Cashflows". Linksys is considering the development of a wireless home networking appliance, called HomeNet. Sales forecast for HomeNet is 50,000 units per year. Linksys expects the product will have a four-year life and an expected wholesale price of $250. Actual production will be outsourced at a cost of $110 por unit Linksys will rent the lab space but will need to purchase $7.5 million of new equipment. The lab will be operational at the end of one year Linksys expects to spend $2.8 million per year on rental costs for the lab space. The lab equipment will be depreciated using the straight-line method over a 5-year life Linksys' marginal corporate tax rate is 40% The cost of capital for this project is 12.00% How much is the annual "Year 1 to Year 4" incremental free cashflow for this project (in millions)? Enter your answer in the following format: + or -1.23; Hint : Answer is between 2.65 and 3.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts