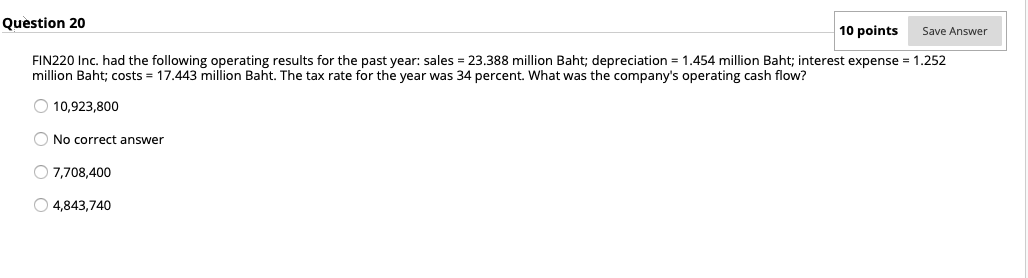

Question: Question 20 10 points Save Answer FIN220 Inc. had the following operating results for the past year: sales = 23.388 million Baht; depreciation = 1.454

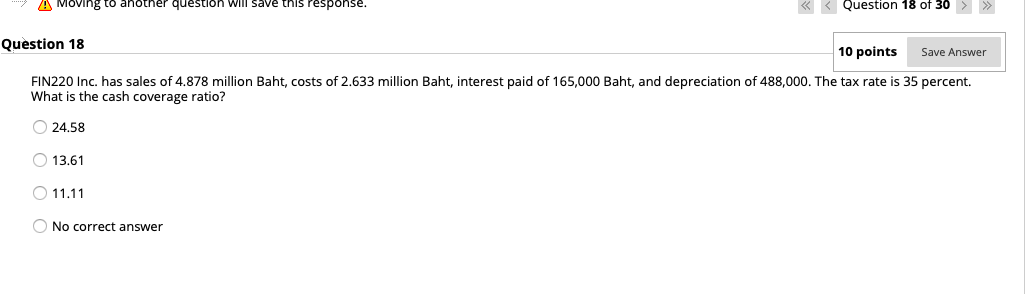

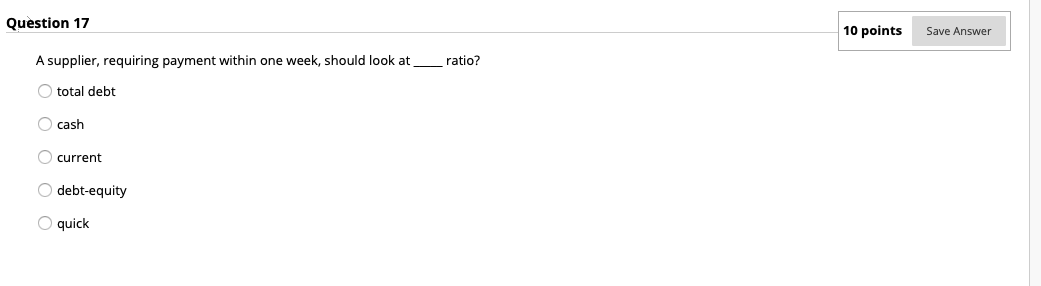

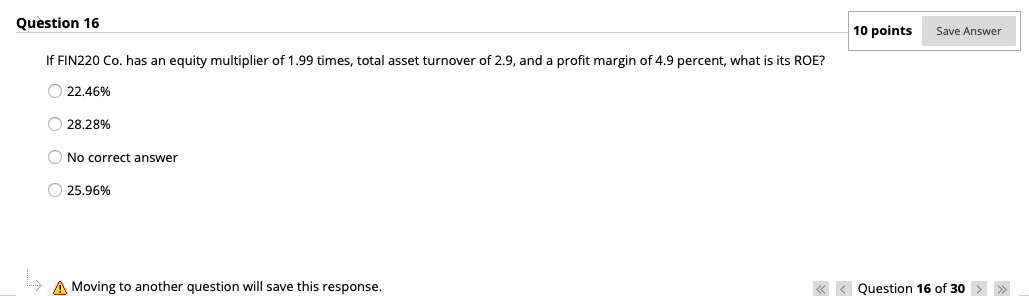

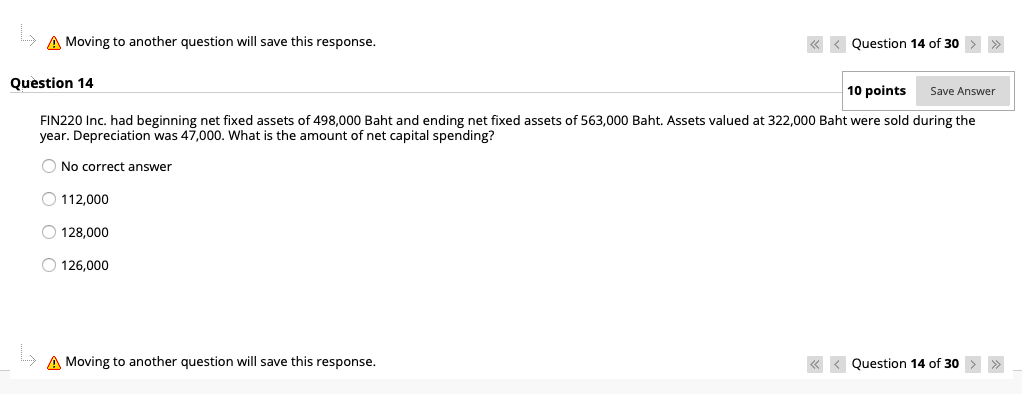

Question 20 10 points Save Answer FIN220 Inc. had the following operating results for the past year: sales = 23.388 million Baht; depreciation = 1.454 million Baht; interest expense = 1.252 million Baht; costs = 17.443 million Baht. The tax rate for the year was 34 percent. What was the company's operating cash flow? 10,923,800 No correct answer 7,708,400 4,843,740 A Moving to another question will save this response. Question 18 10 points Save Answer FIN220 Inc. has sales of 4.878 million Baht, costs of 2.633 million Baht, interest paid of 165,000 Baht, and depreciation of 488,000. The tax rate is 35 percent. What is the cash coverage ratio? 24.58 13.61 11.11 No correct answer Question 17 10 points Save Answer A supplier, requiring payment within one week, should look at __ratio? total debt O cash O current debt-equity quick Question 16 10 points Save Answer If FIN220 Co. has an equity multiplier of 1.99 times, total asset turnover of 2.9, and a profit margin of 4.9 percent, what is its ROE? 22.46% 28.28% No correct answer 25.96% A Moving to another question will save this response. >> A Moving to another question will save this response. Question 14 of 30 > >> Question 14 10 points Save Answer FIN220 Inc. had beginning net fixed assets of 498,000 Baht and ending net fixed assets of 563,000 Baht. Assets valued at 322,000 Baht were sold during the year. Depreciation was 47,000. What is the amount of net capital spending? No correct answer 112,000 128,000 O 126,000 A Moving to another question will save this response.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts