Question: Question 20 (2 points) A company adopted the dollar value LIFO method in 2014. The company's accountants have provided you with the following information: 2014:

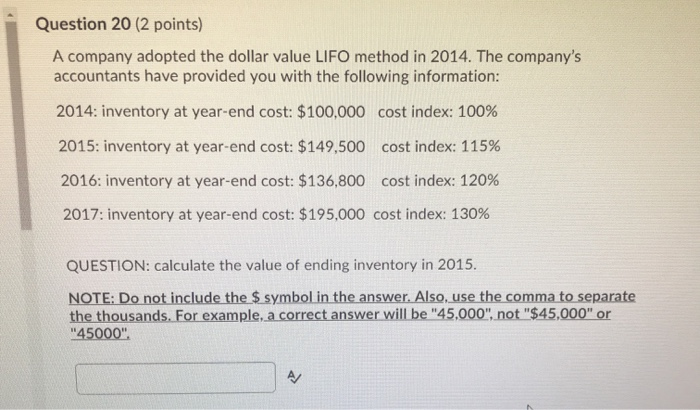

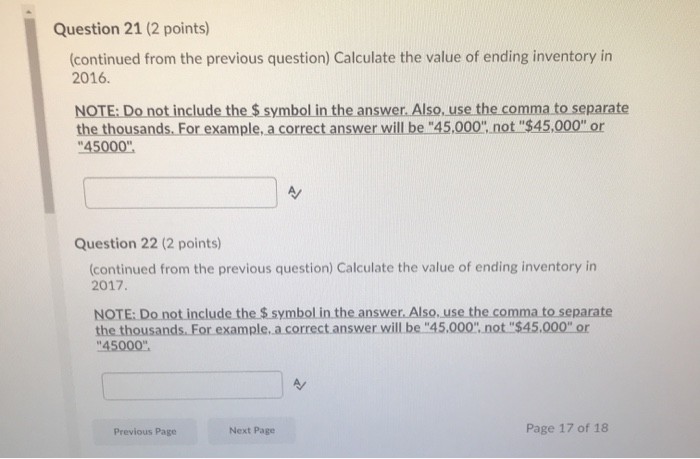

Question 20 (2 points) A company adopted the dollar value LIFO method in 2014. The company's accountants have provided you with the following information: 2014: inventory at year-end cost: $100,000 cost index: 100% 2015: inventory at year-end cost: $149,500 cost index: 115% 2016: inventory at year-end cost: $136,800 cost index: 120% 2017: inventory at year-end cost: $195,000 cost index: 130% QUESTION: calculate the value of ending inventory in 2015. NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45,000", not "$45,000" or "45000". Question 21 (2 points) (continued from the previous question) Calculate the value of ending inventory in 2016. NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45,000", not "$45,000" or "45000" Question 22 (2 points) (continued from the previous question) Calculate the value of ending inventory in 2017 NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45.000" not "$45.000" or "45000" Previous Page Next Page Page 17 of 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts