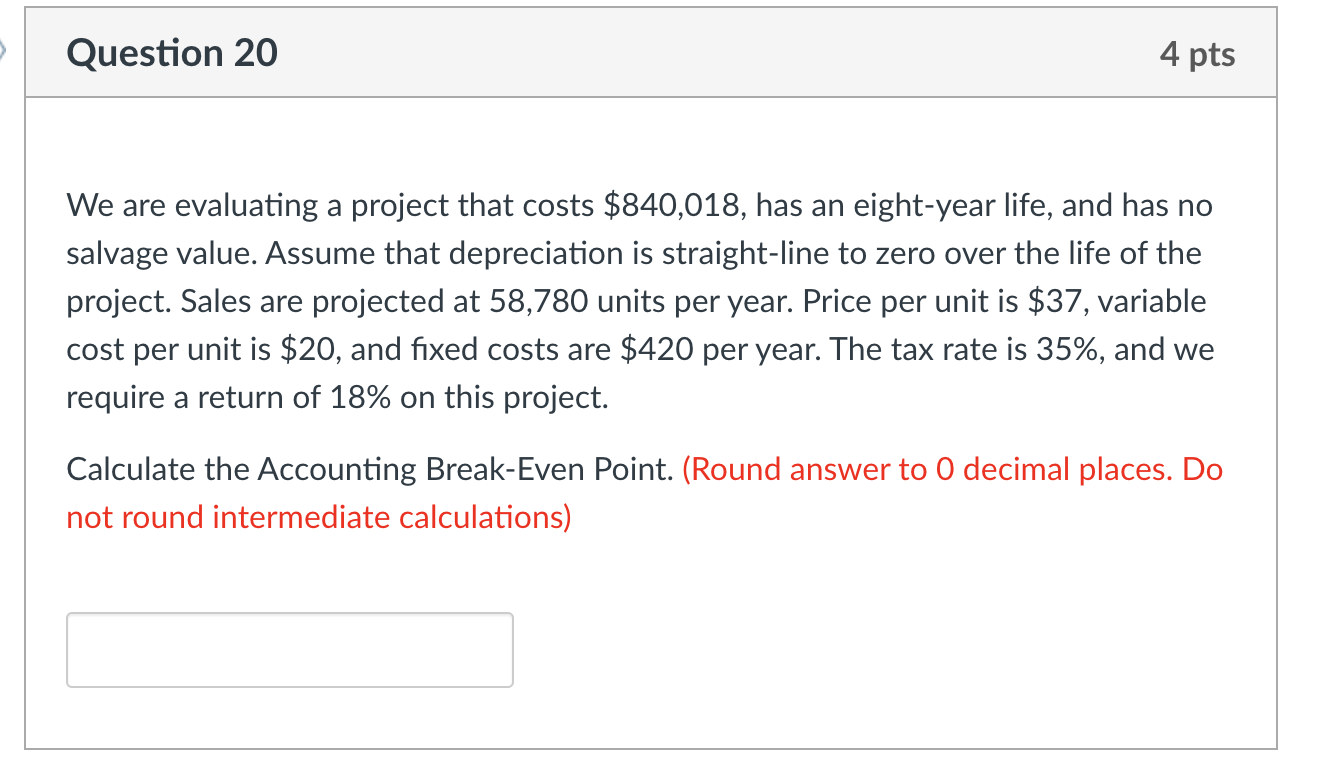

Question: Question 20 4 pts We are evaluating a project that costs $840,018, has an eight-year life, and has no salvage value. Assume that depreciation is

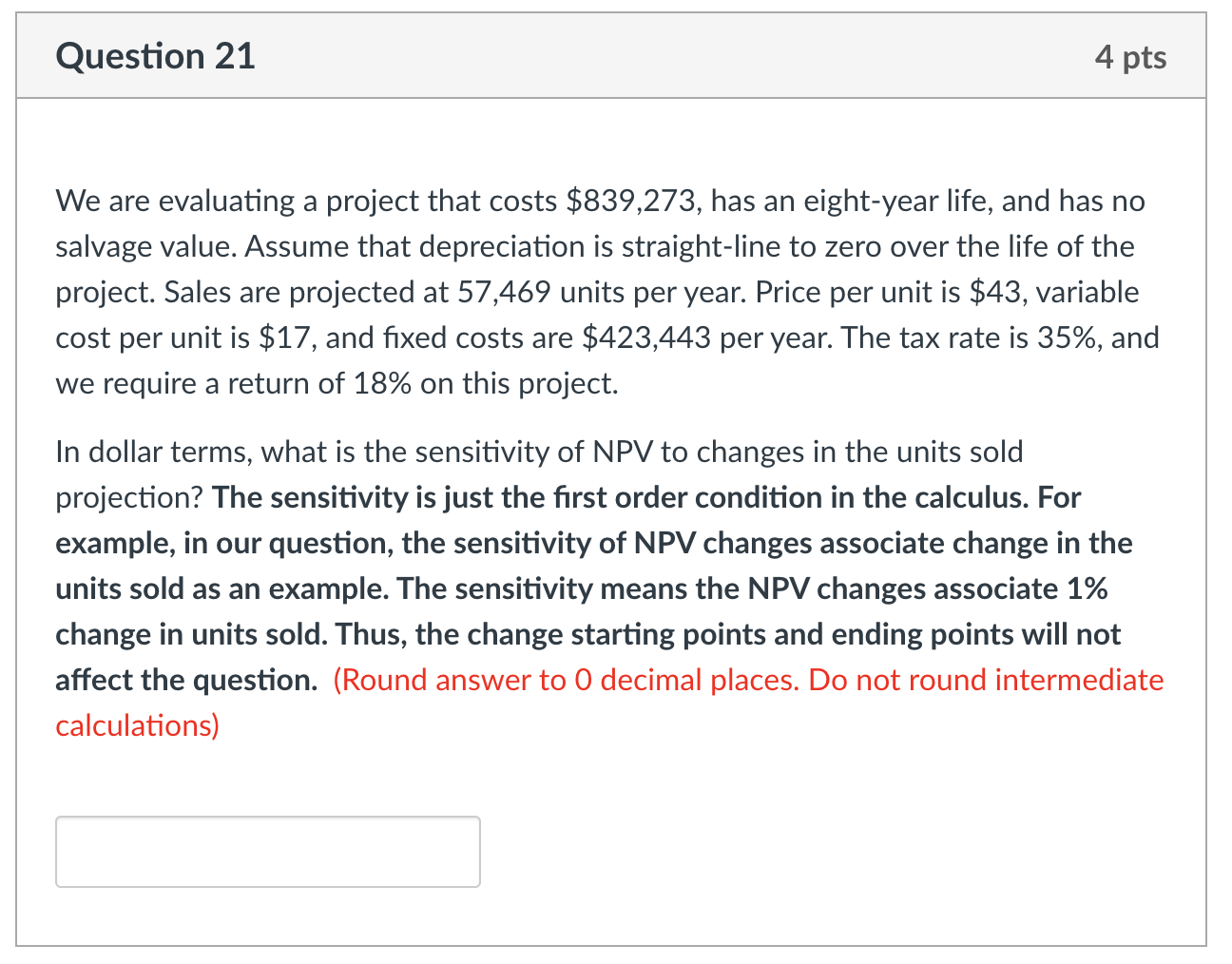

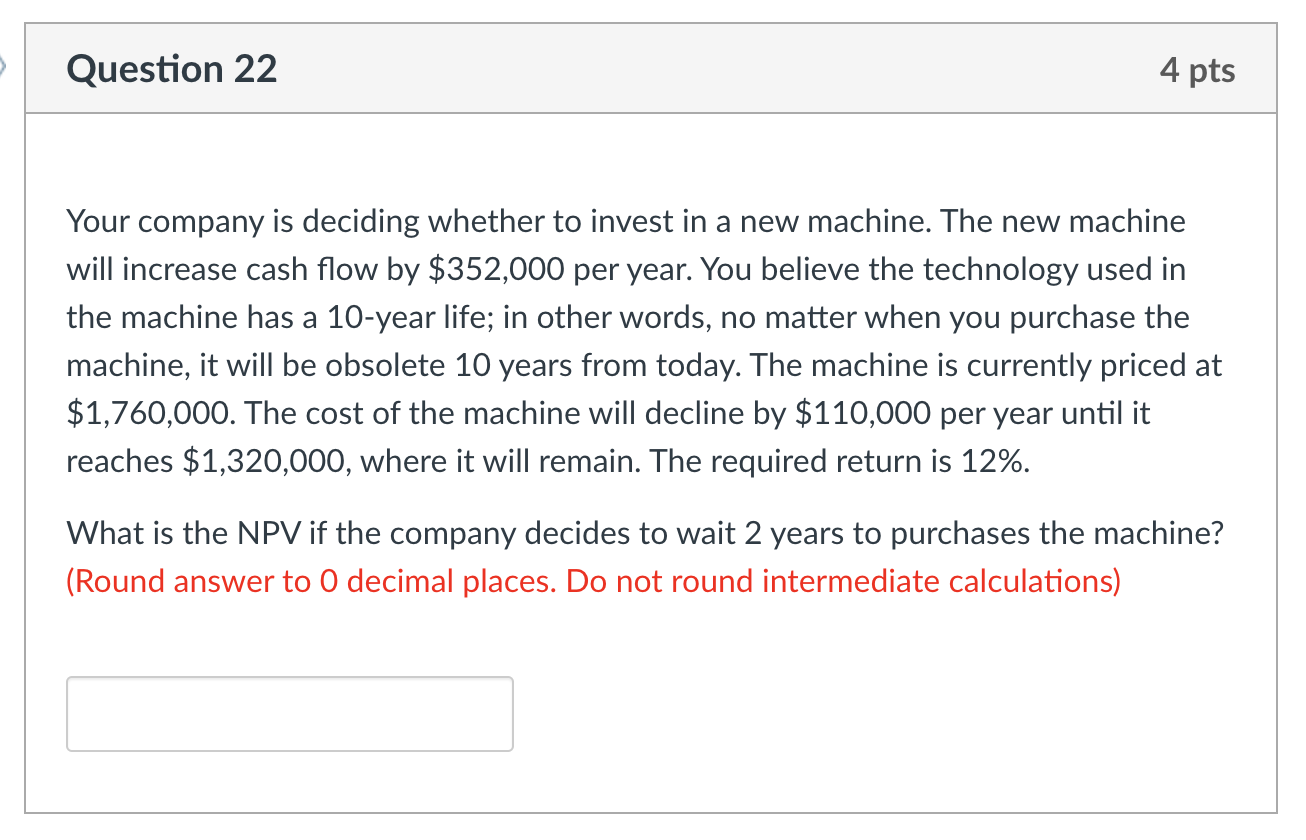

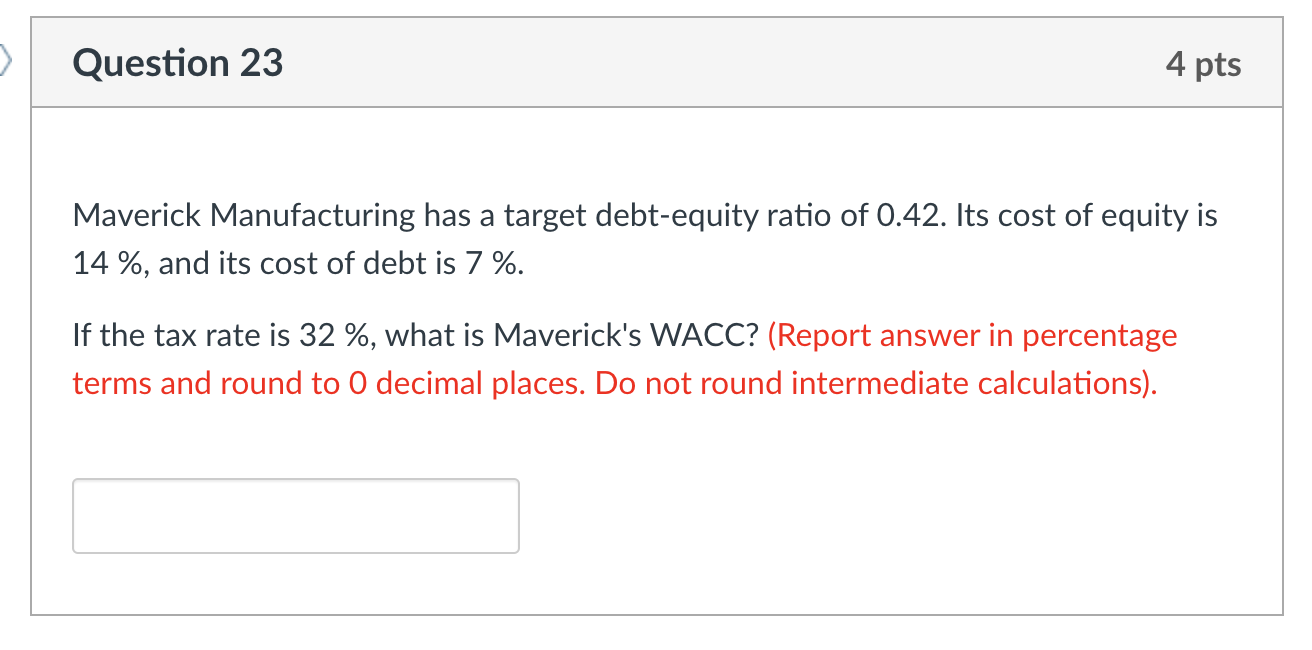

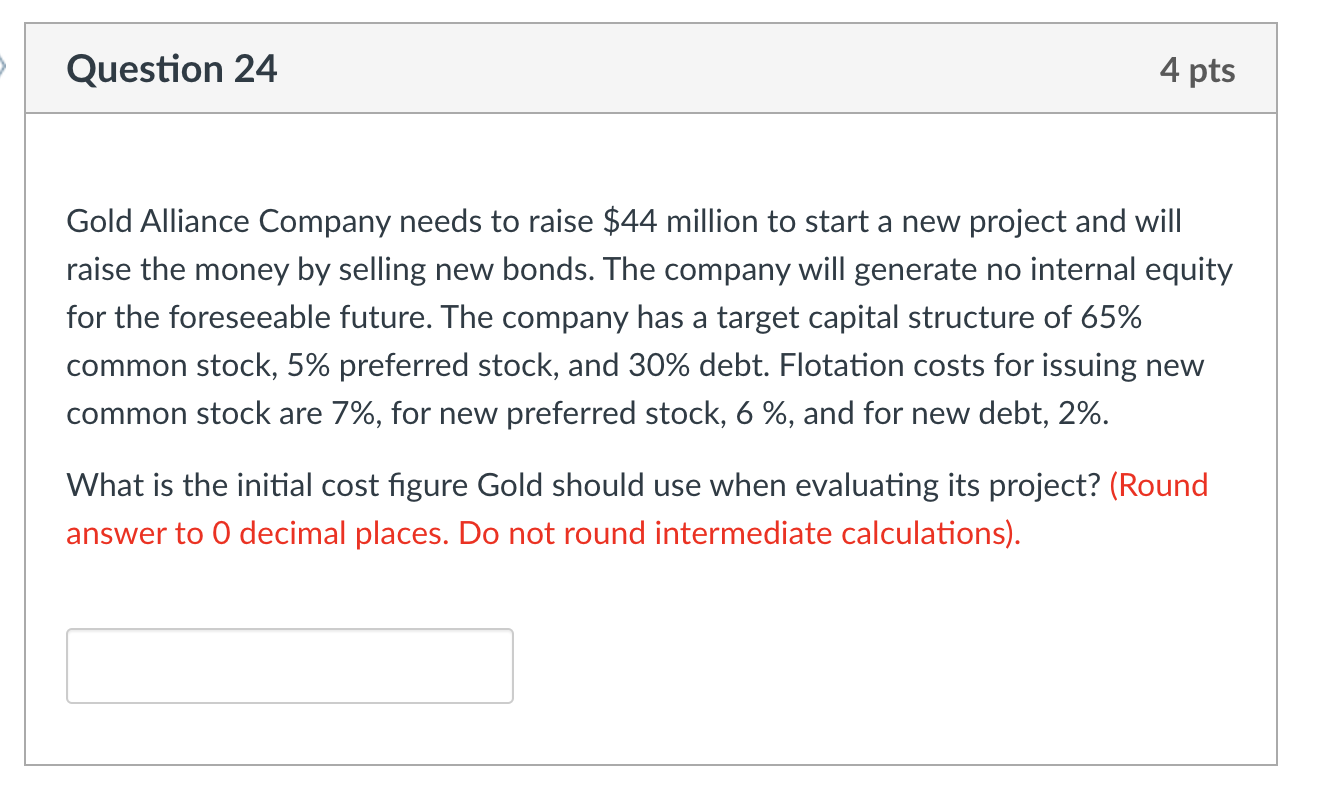

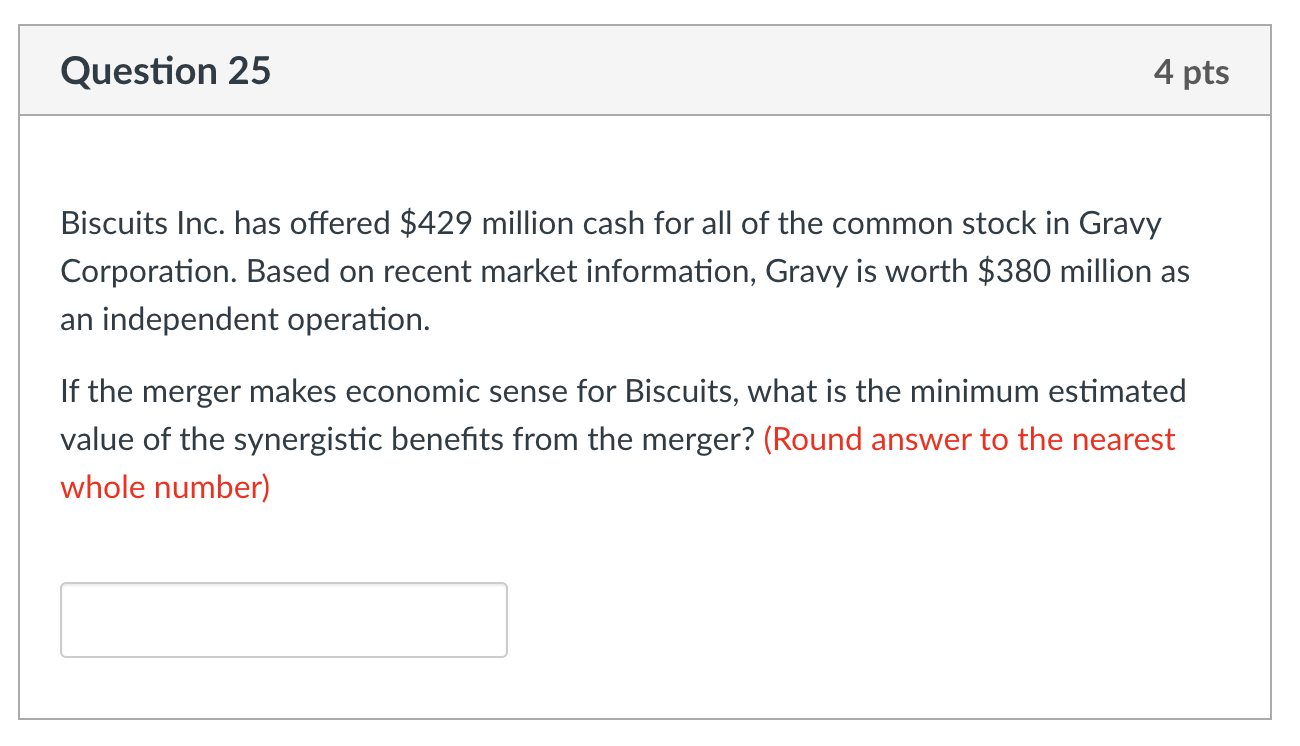

Question 20 4 pts We are evaluating a project that costs $840,018, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 58,780 units per year. Price per unit is $37, variable cost per unit is $20, and fixed costs are $420 per year. The tax rate is 35%, and we require a return of 18% on this project. Calculate the Accounting Break-Even Point. (Round answer to O decimal places. Do not round intermediate calculations) Question 21 4 pts We are evaluating a project that costs $839,273, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 57,469 units per year. Price per unit is $43, variable cost per unit is $17, and fixed costs are $423,443 per year. The tax rate is 35%, and we require a return of 18% on this project. In dollar terms, what is the sensitivity of NPV to changes in the units sold projection? The sensitivity is just the first order condition in the calculus. For example, in our question, the sensitivity of NPV changes associate change in the units sold as an example. The sensitivity means the NPV changes associate 1% change in units sold. Thus, the change starting points and ending points will not affect the question. (Round answer to O decimal places. Do not round intermediate calculations) Question 22 4 pts Your company is deciding whether to invest in a new machine. The new machine will increase cash flow by $352,000 per year. You believe the technology used in the machine has a 10-year life; in other words, no matter when you purchase the machine, it will be obsolete 10 years from today. The machine is currently priced at $1,760,000. The cost of the machine will decline by $110,000 per year until it reaches $1,3 O, where it will remain. The required return is 12%. What is the NPV if the company decides to wait 2 years to purchases the machine? (Round answer to O decimal places. Do not round intermediate calculations) Question 23 4 pts Maverick Manufacturing has a target debt-equity ratio of 0.42. Its cost of equity is 14 %, and its cost of debt is 7 %. If the tax rate is 32 %, what is Maverick's WACC? (Report answer in percentage terms and round to O decimal places. Do not round intermediate calculations). Question 24 4 pts Gold Alliance Company needs to raise $44 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 65% common stock, 5% preferred stock, and 30% debt. Flotation costs for issuing new common stock are 7%, for new preferred stock, 6 %, and for new debt, 2%. What is the initial cost figure Gold should use when evaluating its project? (Round answer to 0 decimal places. Do not round intermediate calculations). Question 25 4 pts Biscuits Inc. has offered $429 million cash for all of the common stock in Gravy Corporation. Based on recent market information, Gravy is worth $380 million as an independent operation. If the merger makes economic sense for Biscuits, what is the minimum estimated value of the synergistic benefits from the merger? (Round answer to the nearest whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts